A

critical review of Logistics Partnership, Innovation, Green, Value-add,

Electricity, and Integration in supply chain

一個評論性的探討之物流夥伴關係,創新,綠色,增值,電子及整合在供應鍊

Author:

Chen Der-FU

Candidate

of Doctor of Business Administration

International

Graduate School of Management

University

of South Australia

Email:

teacher2001@ms52.url.com.tw

Abstract

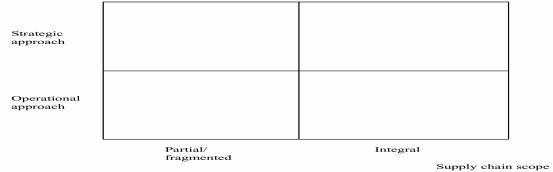

The study review logistics partnerships in supply chain and discuss innovation, green, value-added and e-supply chain, finally, develop an integrated supply chain model for industries.

To

explore some important management theories, practice and issues regarding

logistics partnership, innovation, green, value-added supply chain and e-supply

chain, finally, integrated as: 1.Partial integration 2.full integration or

3.cross-flow synergies.

To

provide corporation to maintain sustained competitive advantage in Internet and

www era; Exploring out a more complete conceptual model structure make

corporation more fit fast changing environment and increase business

competitiveness and reduce cost of business process. More important, the

integration of supply chain can maintain partnership and long term cooperative

relationship among all supply chain members.

Keywords: Logistics partnerships, Innovation, Green, Value-added, e-supply chain, Integrated supply chain

1.

Introduction

Background and Motivation

Into the 21st century, almost have not any corporation can survive only by oneself, therefore corporation must regard ”logistics partnership” in their supply chain, and in advance, they need innovation, green, value-added and “e” supply chain.

Considering the environment protection issues is the trend of modern corporation, therefore corporation as well as earning money need do their best to create green supply chain, at the same time, they can add value for themselves and consumers even whole environment, it’s a social responsibility.

Finally, facing the Internet era, if any corporation want successful and maintain their competitive advantage they must electronically their business process and extending to all supply chain. To form a e-supply chain, then they just can catch up the internet and www trend, and utilize its character: conveniences, speed, low-cost, generalization, globalization and so on, To increase corporation competitiveness and maintain long-term cooperation relationship with all supply chain members.

Objective

of the study

To

explore some important management theories, practice and issues regarding

logistics partnership, innovation, green, value-added supply chain and e-supply

chain, finally, integrated as: 1.Partial integration 2.full integration or

3.cross-flow synergies. To provide corporation to maintain sustained competitive

advantage in Internet and www era; Exploring out a more complete conceptual

model structure make corporation more fit fast changing environment and increase

business competitiveness and reduce cost of business process. More important,

the integration of supply chain can maintain partnership and long term

cooperative relationship among all supply chain members.

Range of the study

Including logistics partnership, innovation supply chain, green supply chain, value-added supply chain, e-supply chain and integrated supply chain. And through the newest literature critical review and re-arrangement, try to explore some proposition and form a research model, conceptual structure. Individual describe as following:

1.1 Logistics partnership: Barriers to partnerships and Logistics partnership

1.2 Innovation

1.3 Green supply chain

1.4 Value added supply chain

1.5 E-supply chain

1.6 Integrated supply chain

Methodology

The study is an exploratory study, it use data-collection, content analysis, and Literature-based critical to construct some propositions and a conceptual model. To produce some conclusions and recommendations for enterprises operation in Logistics Partnership, Innovation supply chain, Greening supply chain, Value-add supply chain, e-supply chain, and Integration in supply chain. To increase enterprises sustained competitive advantage.

Process

of the study

Process of the study is from relative literature collection, content analysis, literature critique and overseas case study to explore a research conceptual model and proposition induction. Finally, to produce conclusions and recommendations.

1.1 Logistics partnership

Bernard Burnes and Ron Coram, 1999 in "Barriers to partnerships in the public sector: the case of the UK construction industry" This article examines the changes in the relationship between government departments and the UK construction industry brought about by the privatization of the Property Services Agency (PSA). In particular, it shows that while there has been some encouragement for closer, and more long-term, collaboration, in reality government departments seem to be stuck in a short-term, win-lose orientation. The article concludes by arguing that this is a product of four factors: the lack of experience among both purchasers and providers of long-term partnership arrangements; the risk-aversive nature of the Civil Service; the pressure on departments from ministers to minimize risk; and government guidelines on competitive tendering which make it difficult to enter into long-term agreements.</SMALL>

Logistics partnership

Much of the material written about logistics partnerships presents the perspectives of partners shortly after the partnership has commenced. This paper focuses on the evaluation of a logistics partnership between a large retailer and a provider of international logistical service based on five years of operating experience. The authors believe that the insights gained from this partnership have wide applicability and merit discussion. Following a brief discussion of the nature of the partnership, the problem areas are identified. Next, the key lessons learned are summarized and recommendations for other logistics partnerships are made.

1.2 Innovation

It is getting harder and harder to satisfy consumers in mature markets like Europe, Japan and North America. UK manufacturing margins are being squeezed and competition on price is no longer a valid strategy. Increasingly, across many markets, the driving purchase criterion is the consumer’s expectation of the overall experience a product will deliver. Those that do not offer a clearly differentiated experience risk being valued as commodities. A more effective strategy for manufacturers is to not only benchmark on price, or even command a small premium, but differentiate on the basis of consumer experience. In other words, behave like a successful service company. For example, BA invests massively in managing every stage of the consumer experience - from ticket booking to the standard of seating.

This focus on consumer experiences represents the ultimate challenge for manufacturers. New products are delivered into the economy by teams of professionals from different disciplines. In some of these - marketing and sales, for example - the knowledge focus is clearly on the consumer. In other disciplines - technical and creative in particular - the knowledge focus tends to be inward, that is, towards the specification of the product.

In the debate, poor knowledge flow, and entrenched uni-disciplinary attitudes emerge as the main barriers to the creation of better - higher margin - products brought to market in the shortest possible time.

Shared goals, leading to collaborative effort and planning, seem to be the key to achieving reliable products with good functionality at a realistic price. However, to achieve the goal of a well-managed consumer experience a much higher level of knowledge transfer is needed, between consumer-facing disciplines such as marketing and design towards delivery disciplines such as engineering and manufacturing.

To achieve this higher level of integration, the innovation process needs to be seen as a knowledge supply chain - whose efficiency is measured by the extent to which a vision of the target experiences reaches each link in the chain.

In parallel, other factors, such as intense price competition, are working to make integration even harder. To achieve maximum efficiency, professionals in different disciplines tend more and more to work for different companies, often in different countries or on different continents. Commercial and cultural barriers abound.

Information technology is helping information flow and is a parallel catalyst for change in the innovation process. However, to achieve any effective change, current underlying attitudes need to be understood and altered if they present an obstacle to progress.

By examining attitudes along the innovation supply chain, we can see what needs to change and how each discipline helps the collective to deliver better consumer experiences.

Suppliers and collaborating partners can assist the innovation process through access to technologies, skills or information (Dodgson, 1993; de Meyer, 1991; Hayes and Abernathy, 1980) and through providing complementary expertise improve the speed to market of new product developments (Child and Faulkner, 1998).

1.3 Green supply chain

If a supply chain is to really assume responsibility over its ecologic footprint it is to be evaluated on these grounds. The supply chain footprint has to be measured against different indicators than the original footprint measure. In that respect, a set of performance measures relevant for these activities is identified and listed in the final row of Table I. Materials can be selected against emission rate and energy consumption standards. Re-use of materials can be measured against the percentage of virgin or new materials used in parts production. Ideally, this percentage should be as low as possible. Dis-assembly and shredding can be measured as volume of goods handled per time unit. Transportation can be assessed in terms of loads against capacity of transport equipment. A high degree of utilization is an indicator of the efficiency of transportation. Driving empty trucks around creates emissions without economic value. Packaging cannot only be evaluated based on packaging material used but also by the amount of air or useless space in the package. Returns handling can be measured in terms of volumes handled to indicate the size of the operation. More important is the volume selected for recycling/entering the re-use supply chain, as this provides an indication of the effectiveness of the return flow of goods and the value of products returned.

1.4 Value added supply chain

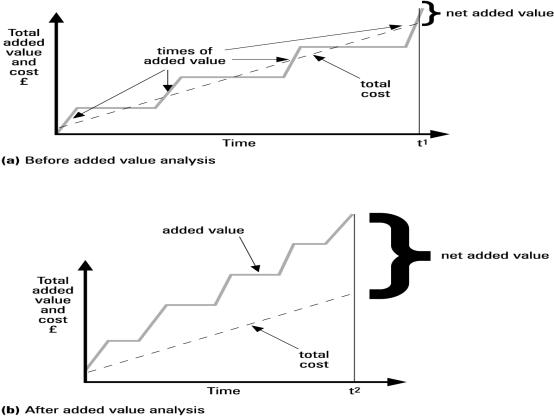

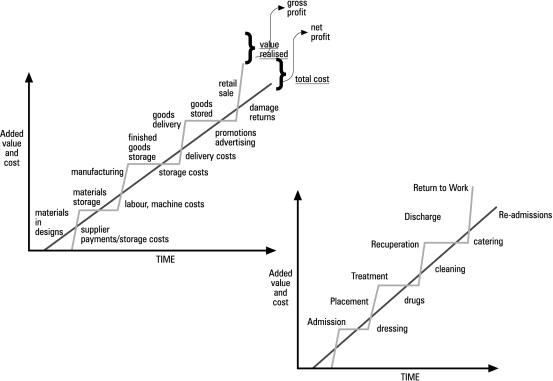

Value or supply chain management has traditionally focused on maximizing the opportunities to add value while minimizing total cost. Net added value is increased by compressing the times when no value is being added and costs continue to rise. t1 is reduced to t2 and net value added has been substantially increased because it has been possible to cut the times and hence the costs involved in testing, storing, counting, processing and controlling materials and products. The costs of capacity and of waste have usually also been reduced.

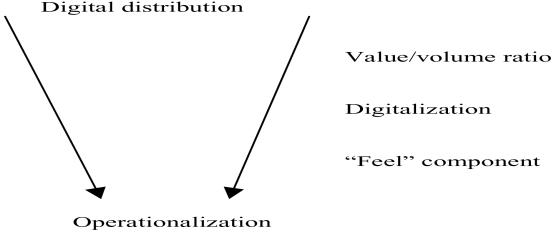

1.5 E-supply chain

It is often claimed that information and communication technologies (ICT) will be for the economy what steam and machine power were to the industrial revolution. Riding this wave, e-business is coming to the forefront of international markets. Various new players have driven existing players to respond with their own Web sites and the development of electronic marketing channels. Such is the momentum for this revolution that Harvard Business School is experiencing a larger number of drop outs in its MBA program because of all the students launching Web companies, and US companies are experiencing difficulty in keeping their chief executives as they aspire to join “dot com” companies. Even though it sometimes looks like the sky is the limit to the (investment) opportunity in e-business, it sometimes looks as if we are e-mailing with Peterus@knocking on heaven's door.

1.6 Integrated supply chain

Within the systems integration supply chain, sustainable profitability appears to be predicated on the ability to utilize effective leverage over end customers through the possession of information asymmetries and to have the capability to use these opportunistically to satisfice customers.

It is clear, therefore, that unless the end customer has a coherent blueprint for the technical solution that responds to its current and future business needs, then they will be at a permanent disadvantage vis-à-vis their suppliers. This is made highly unlikely, however, because the supply industry is, itself, involved in fundamental and rapid technological change. Having an understanding of how this change affects IT processing systems and capabilities becomes a key supply chain resource for systems integrators. Using this knowledge, systems integrators, consultancies and software suppliers are in a position to leverage the ignorance of end customers and, thereby, further increase their own margins. This knowledge can also be a major factor in the creation of dependencies and high switching costs that lock-in the end customer. This approach appears to be the basic strategy for all of the systems integrators analyzed in our research so far.

2.

Literature review

2.1 Barry to partnerships

Short- and long-term relationships

Most of the government officials we interviewed favored short-term relationships with suppliers because they believed they provided greater flexibility in a constantly-changing environment. However, whether or not this is true, government rules on competitive tendering and market testing make it difficult for departments to enter into long-term arrangements (Erridge, 1998). Nevertheless, there are those in the public sector who recognize the downside of short-term contracts.

One might assume that the benefits of customer-supplier partnerships, as developed in many parts of the private sector (Burnes and New, 1996; Kearney, 1994), would have appealed to successive UK governments committed to reducing public expenditure and increasing value for money.

There are four key factors which appear to discourage Civil Servants from establishing longer-term partnerships with the construction industry. First, there is a lack of experience of operating such relationships, both in the public sector and in the private sector. Indeed, given the conflict-ridden nature of the UK construction industry, it is not surprising that government departments shy away from entering into new and untried arrangements with it.

Second, despite attempts to introduce a more entrepreneurial, private sector style of management into the Civil Service, there appears to be an embedded risk-aversive culture in the public sector (Ferlie et al., 1996; Flynn, 1993; Flynn and Williams, 1997). In part, as far as construction contracts are concerned, this appears to be a trait carried over from the days when the PSA ruled the roost.

Third, according to a number of the senior Civil Servants we spoke to, government ministers indicated that they believed that the private sector should bear a major proportion of any risk associated with construction contracts. In this situation, regardless of the inclination of individuals or departments, Civil Servants would need a strong argument to enter into arrangements which might lead to the public sector sharing a greater portion of any risk.

Finally, as Erridge (1998) commented, the rules which now regulate public sector purchasing make it very difficult, though by no means impossible, for departments to enter into long-term partnership-style agreements. It should be pointed out that though these rules are drafted by the UK Government, in some crucial respects, especially in relation to competitive tendering, they also reflect European Union regulations with regard to public sector purchasing.

Logistics partnership

Robert G. House and Theodore P. Stank, 2001 in "Insights from a logistics partnership" this article mentioned, several factors led Melville to seek the services of a consolidated international logistics service provider. First, Melville recognized the need for international logistics expertise in individual divisions that had not developed those capabilities, as well as to supplement the capabilities of other divisions. Second, consolidation of services with one provider would enable Melville to leverage the combined power of multiple divisions to secure superior services at competitive prices. Third, Melville desired the ability to rapidly expand international sourcing without having to develop logistics infrastructure to support such sources. Finally, consolidating services with one provider would facilitate a world class control system to ensure full visibility of the international supply chain from point of order to the point of delivery to the domestic DC. Mercantile was selected because its strategy, management, and capabilities closely aligned with these goals. The vision of the potential of the relationship between the two firms was shared at both the executive and operational level.

Under the terms of the relationship Mercantile Logistics managed all aspects of Melville’s import process from vendors located in the Far East. Mercantile Logistics was responsible for coordinating vendor shipments, consolidating freight, booking ocean and air transportation, coordinating US Customs brokerage activities, and scheduling delivery of shipments to a variety of distribution centers located throughout the USA. Melville’s divisions provided electronic copies of purchase orders and purchase order changes to Mercantile Logistics daily. Mercantile Logistics managed the activities necessary to ensure that shipments were delivered in accordance with the instruction on the purchase orders and reported status information via daily electronic updates to the information systems of Melville’s various divisions.

The partnership was structured to achieve four major operational objectives:

(1) reduce total logistics cost;

(2) reduce transit time;

(3) improve information; and

(4) improve pipeline reliability.

Each of these major objectives was achieved, and in some instances year by year accomplishments widely exceeded expectations. Overall cost was reduced by 12 percent, despite absorbing 2-4 percent per annum increases in ocean freight rates, and reliability was improved to better than 96 percent (measured in terms of purchase orders delivered ± two days of planned due date). Transit times were reduced by more than ten days through the use of an information system that tied purchase order due dates to realistic pipeline planning schedules. The information system also provided event tracking on 20 separate stages of the order cycle as purchase orders moved from buyer to vendor to distribution center.

During its existence the Melville/Mercantile Logistics partnership was responsible for the movement of approximately $5 billion of goods at retail. Product flowed from nearly 40 origin points to as many US-based destinations. The partnership accounted for the movement of nearly 70,000 40ft equivalent (FFE) containers during this time period. The volume of activity made this third-party logistics contract one of the largest of its kind to date. However, the partnership was dissolved after five years when Melville announced a strategic realignment that created three new operating companies, including a drug chain holding company, a footwear company and a toy company. Some business units were sold to other corporations. Two of the remaining companies were primarily domestic in their operations, thus reducing the volume of international logistics to the point where many of the shared economies of scale were no longer available. Thus, the relationship between Mercantile and the resulting businesses was restructured to reflect the more individualized needs and requirements of those operations.

2.2 E-supply chains: virtually non-existing

While Shapiro and Varian (1999) explained that the old rules of economics still apply. Because man (as an economic actor) has not fundamentally changed his behavior so far, What should be noted is that what is called e-business is still largely, in reality, e-commerce and sales and marketing driven only rather than an integral business model.

Amazon, for example had to admit that it charges customers logistics costs which may off-set the price advantage to the customer. More importantly, it had to admit that frequently it does not know what the "true" logistics costs are. Perhaps, one might reason, this contributes to the continued losses the company is experiencing. Losses have increased in line with a growth in turnover last year, and it has been stated that the growth of the company lead to an increase in inventory, especially with product diversity increasing. This implies poor management of logistics and supply processes in this e-business.

Consider these findings from an Arthur Andersen survey of customers purchasing products on-line in the USA, fourth quarter of 1999. In the top ten problems experienced by end-consumers, some are in the category of technology, some are marketing related, but the top two factors are logistical factors, related to supply chain performance. Products not delivered on time or out of stock means receiving Christmas presents mid-February. Experts reflect upon this by pointing out that the dot coms had underestimated the complexities of trading in volatile markets. Nor did they have the systems in place to report emerging stock shortfalls, manage vendors and complaints. Clearly, building a customer-facing Web environment is not all that difficult, but managing it with an underlying business model that includes an e-supply chain is something else. Experts (Andersen and others) suggest:

Supply chain failures are compounded by a lack of rapid reporting structures to identify emerging stock shortfalls, order processing systems to manage the needed repeats, and vendor quality management programs to ensure minimal complaints and returns.

These companies have dressed the shop window with slick Web sites, but there is no technology behind it to fulfil the order. Systems are already inadequate for big volumes, before adding new developments using mobile phones to access the Web. Companies are creating a demand they simply cannot fulfil.

Additionally, we are currently in the midst of what might be called the second wave of e-business. The first wave was that of the start up dot coms, some of which have already gone bankrupt – others are now more carefully monitored at the stockmarket, and hardly any have yet fully delivered on their promises. Thus, the second wave may become more important as it centers around existing companies with a heritage in the brick-and-mortar world who are now penetrating the e-business environment. Companies with existing and well-established processes and performance are now adding e-business to their portfolio and many are investing deeply. Their experience may help enhance performance of e-business concepts, but their heritage may also hinder drastic adjustments to their business model.

The second wave indicates how e-business is seen as a general and massive e-business opportunity in many sectors of the economy, and how expected revenues are high (judging upon the size of initial investments). The main argument, however, is that, in order to earn back investments and realize the promise of e-business, the creation of e-supply chains is needed, especially now that more experienced companies are becoming involved and investments in e-business are rising. The e-supply chain is the physical dimension of e-business with the role of achieving base level operational performance in the physical sphere (fulfillment, etc.). Additionally, it provides a backbone to help realize more advanced e-business applications that companies will obviously be unable to achieve if base level performance is not even up to market requirements, as indicated in Table I.

In order to introduce the relevance of e-business from a

supply chain perspective, the next section will explain how e-business

applications can support the realization of supply chain objectives. Supply

chain approaches to e-business will then be developed. In these approaches the

creation of an e-supply chain is considered of central importance. This is aimed

at moving beyond the poor supply chain organizations underlying current

e-business applications. In order to further support the realization of

e-business objectives through the e-supply chain, relevant innovative practices

are then developed. These are aimed at furthering the contribution of the

e-supply chain, making it a backbone of revenue creation that can help earn back

the amount of investment and effort currently going into e-business.

The relevance of e-business to the supply chain

Theoretically, there are multiple benefits from using information and electronic business concepts in the supply chain. Various authors have reflected on the specific potential of ICT for individual functional areas such as marketing (McKenna, 1997), purchasing (Ellinger and Daugherty, 1998) and logistics. In particular, ICT is expected to make the flow of goods transparent (Bowersox and Daugherty, 1995), allow for the integrated management of a physically des-integrated unit (LaLonde and Powers, 1993), and decentralization and centralization within one operating system (Bowersox et al., 1992). More specifically, Lee et al. (1997) point to the relevance of information exchange in avoiding one of the best known problems in the supply chain, that of Forrester's bullwhip effect.

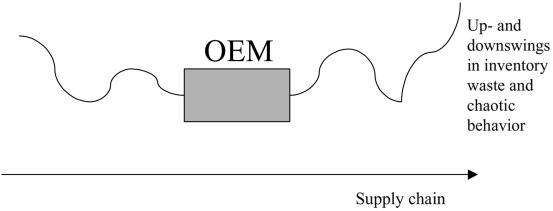

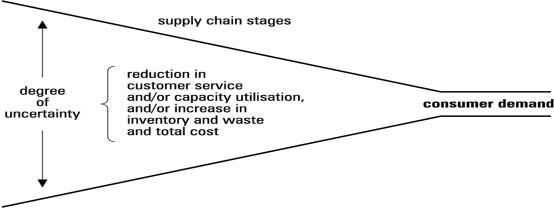

The theory says that irregularities and unpredictability in order quantities increase with the number of layers in the chain. Because a supplier faces uncertainty about the order quantities of a direct customer, he will anticipate demand with inventory, speculative production, etc. Because the supplier of the supplier faces the same uncertainty in his relation with the supplier of the customer, the supplier’s supplier will face considerable volatility and further anticipate orders, leading to even greater speculation at this point in the supply chain. Specifically, orders to suppliers tend to have larger variance than sales to the e-buyer and the distortion propagates upstream in an amplified form. This is a result of information transferred in the form of sequential orders (with tight time windows for delivery) being distorted and misguiding upstream supply chain members in their production and inventory decisions. In addition to the upstream cumulative volatility in inventory, waste and possible chaotic behavior which result from the Forrester effect, the effect can be experienced not only upstream in the chain but also downstream, as displayed schematically by the volatility in the supply chain moving upstream and downstream from the original equipment manufacturer in Figure 1 Traditional supply chains are suffering from poor information exchange .

Figure

1: Traditional supply chain

In traditional supply chain arrangements where the manufacturer or original equipment manufacturer (hereafter: OEM) is often the focal company, supply chain optimization may be driven by the considerations of that company, rather than from a supply chain optimization perspective, so creating Forrester effects up- and downstream throughout the chain. According to Lee et al. (1997) information and management can provide an important remedy for these effects. In the sphere of information and technology, visibility of demand throughout the supply chain and electronic linkages to create transparency of orders and operations are among the remedies studied.

If the information flow is such an important element of the supply chain, why do information-based companies such as Amazon achieve such poor supply chain performance? The answer probably has more to do with management solutions than technology. In that respect, the next section will introduce management approaches relevant to realizing the virtual supply chain.

2.3 The innovation supply chain

The use of outside supply may enhance an organization’s ability, this focus on consumer experiences represents the ultimate challenge for manufacturers. New products are delivered into the economy by teams of professionals from different disciplines. In some of these - marketing and sales, for example - the knowledge focus is clearly on the consumer. In other disciplines - technical and creative in particular - the knowledge focus tends to be inward, that is, towards the specification of the product.

In the debate, poor knowledge flow, and entrenched uni-disciplinary attitudes emerge as the main barriers to the creation of better - higher margin - products brought to market in the shortest possible time.

Shared goals, leading to collaborative effort and planning, seem to be the key to achieving reliable products with good functionality at a realistic price. However, to achieve the goal of a well-managed consumer experience a much higher level of knowledge transfer is needed, between consumer-facing disciplines such as marketing and design towards delivery disciplines such as engineering and manufacturing.

To achieve this higher level of integration, the innovation process needs to be seen as a knowledge supply chain - whose efficiency is measured by the extent to which a vision of the target experiences reaches each link in the chain.

In parallel, other factors, such as intense price competition, are working to make integration even harder. To achieve maximum efficiency, professionals in different disciplines tend more and more to work for different companies, often in different countries or on different continents. Commercial and cultural barriers abound.

Information technology is helping information flow and is a parallel catalyst for change in the innovation process. However, to achieve any effective change, current underlying attitudes need to be understood and altered if they present an obstacle to progress.

By examining attitudes along the innovation supply chain, we can see what needs to change and how each discipline helps the collective to deliver better consumer experiences.

The use of outside supply may enhance an organization's ability to provide a wider product range and to diversify. Focusing on a narrower range of activities may allow core activities to be more easily levered to achieve a wider product range (Quinn et al., 1990); the amount of investment required to enter a new business area can be reduced and there can be easier achievement of optimum performance (Snow et al., 1992). Suppliers and collaborating partners can assist the innovation process through access to technologies, skills or information (Dodgson, 1993; de Meyer, 1991; Hayes and Abernathy, 1980) and through providing complementary expertise improve the speed to market of new product developments (Child and Faulkner, 1998).

Technology

In large part the company's in-house manufacture of core products can be seen as a result of the specific nature of the manufacturing technology required (Ellram, 1990). While most of the equipment was available through outside purchase, the use of a considerable group of in-house technologists had developed an efficient system that achieved the particular product characteristics. For the in-house manufacturer-retailer the wide spread of technologies may result in particular areas being at times neglected, restricting the effectiveness of the total system in responding to market conditions. On a number of occasions difficulty in matching supply to retail demand had resulted in costly write-offs when new product initiatives failed to develop sales. Under investment in retail technology may reflect the difficulties in sustaining the full range of technologies required by the vertically integrated company.

2.4

Collaborative planning: supporting automatic replenishment programs

In an ideal world, supply chain partners would work together to rethink and restructure business practices, as necessary, to provide consumers with products and services better/faster/cheaper than ever before. System success would be predicated on a free exchange of critical information and commitment to reaching shared goals. While this may sound somewhat removed from reality, such a scenario is fairly close to what many leading edge companies are doing today (Davis, 1998). Automatic replenishment systems have been implemented in a great number of firms in recent years. With automatic replenishment programs (ARP), inventory restocking is triggered by actual needs rather than relying on long-range forecasts and layers of safety stock “just in case” (Andel, 1996; Cottrill, 1997; Keh and Park, 1997).

Some firms that have instituted ARP are now taking supply chain co-operation to another level through involvement in collaborative planning/forecasting/replenishment (CPFR). CPFR attempts to lessen the problems associated with traditional anticipatory demand forecasts by co-operating with trading partners to better match supply and demand. Thus, it makes firms better prepared and ready to respond to market signals.

ARPs provide day-to-day guidance for inventory replenishment. In contrast, CPFR relates to long-term planning. CPFR involves collaborating and jointly planning to make long-term projections, which are constantly updated based on actual demand and market changes (competitive efforts, new promotional plans, etc.). CPFR has been described as a step beyond efficient consumer response, i.e. automatic replenishment programs, because of the high level of co-operation and collaboration needed (Tosh, 1998).

Traditionally, separate and disjointed operating units across companies have independently made plans. This has often resulted in “uncoordinated store, procurement, and logistics planning for the retailer while manufacturers see sales, distribution, and production planning being out of synch” (Koloszyc, 1998, p. 28). CPFR attempts to eliminate such problems through detailed exchange of point-of-sale and other information on a real-time basis (Wolfe 1998). Internal co-ordination is also needed. As Joseph Andraski, vice president of customer marketing operations at Nabisco has noted, many companies develop forecasts in disparate areas including marketing, finance, purchasing, and logistics. There is no assurance that these plans will ever “come together” or be reconciled. Instead, someone within the organization makes a decision as to which forecast to use. Valuable input from the individual areas is lost. Co-ordination is needed to bring the separate forecasts together into a single plan (Tosh, 1998).

Industry-level planning has provided the major impetus for CPFR. Five companies - consultant Benchmarking Partners, manufacturer Warner-Lambert, retailer Wal-Mart, and two software firms, SAP and Manugistics - initiated the CPFR project in October of 1995 (Cooke, 1998). A business model was developed and tested with Wal-Mart and Warner-Lambert. The initial pilot involving Listerine products was deemed a success. Since that time, VICS (Voluntary Inter-industry Commerce Standards) Committee, long known for their involvement in developing industry-wide standards for EDI, has become involved in efforts focused on improving supply chain management through collaborative partnerships between retailers, distributors, suppliers, carriers, third party providers, and any other relevant trading partners. In order to better understand key dimensions of collaboration, VICS set up the Dynamic Information Sharing Business Collaboration subcommittee (Staff, 1998). Twenty-six leading companies participated in the subcommittee (Voluntary Interindustry Commerce Standards, 1998). The focus of the subcommittee has been to develop voluntary guidelines for CPFR involvement.

CPFR is a collaborative initiative aimed at "making inventory management more efficient and cost-effective, while improving customer service, and leveraging technology to significantly improve profitability". Efficiency measures how well resources expended are utilized while effectiveness involves the extent to which goals are accomplished (Mentzer and Konrad, 1991). Thus, performance is a function of both efficiency (inputs) and effectiveness (goals/outputs).

CPFR represents a new management philosophy. Perhaps the best way to capture the breadth of CPFR is to provide an illustration. Utilizing principles of CPFR, a retailer and consumer goods firm would work together to jointly create a single, combined promotion calendar in advance of the selling period which could subsequently be up-dated on a real-time basis over the Internet. The retailer would also provide point-of-sale (POS) data, longer-term promotional plans, prescribed inventory levels, etc. for the consumer goods trading partner. Both firms would create sales and order forecasts. The retailer would then electronically transmit the retail forecast to the consumer goods firm (manufacturer). A collaborative system would be used to compare that forecast to the consumer goods firm’s own forecast. Discrepancies or exceptions would be identified and appropriate managers advised. Working together, the "team" would decide on one, i.e. collaborative, forecast extending across the supply chain.

The above example attempts to capture the essence of CPFR - utilizing technology/information capabilities to support trading partner interaction and joint decision making. While the above scenario is generic, it should be noted that in actuality CPFR agreements are very specific in nature. A great deal of time and effort is needed up-front to negotiate specific items such as goals and objectives, frequency of up-dates to the plan, exception criteria, and key measures. The result is a published document defining relevant issues that has been jointly developed and agreed to. A nine-step business model for CPFR (Robins, 1998) has been developed which provides an indication of the scope of effort involved:

Develop front-end agreement.

Create joint business plan.

Create sales forecast.

Identify exceptions for sales forecast.

Resolve/collaborate on exception items.

Create order forecast.

Identify exceptions for order forecast.

Resolve/collaborate on exception items.

Order generation.

The following quote concisely summarizes the CPFR philosophy and how it "focuses on the process of forecasting supply and demand [through] efforts to bring various plans and projections from both the retailer and supplier end of the supply chain into synch" (Tosh, 1998, p. 113). The spirit of such collaboration is consistent with Bowersox's definition of supply chain management:

Supply-chain management is a collaborative-based strategy to link cross-enterprise business operations to achieve a shared vision of marketing opportunity (Quinn, 1998, p. 38).

Impact of CPFR

A number of pilot programs testing CPFR concepts have been instituted in the last few years. The goals of the pilot programs are to validate and refine the VICS-developed CPFR business process and technology recommendations. Pilot results have been very positive. The firms involved reported they improved their in-stock positions while achieving significant reductions in inventory levels (Robins, 1998). For example, a pilot program established between Nabisco and Wegmans Food Markets reported sales increases of up to 50 per cent in the pilot categories. Forecast accuracy improved to the 90 per cent range (Zimmermann, 1998). Improvements in overall channel efficiency through better asset utilization, reduced risk through co-management of inventory, and better day-to-day management because of prenotification of fill-rate issues are other anticipated benefits. Manufacturers benefit in that CPFR means fewer expedited shipments and more accurate production; however, it also means greater accountability for manufacturers (Koloszyc, 1998).

Pilot programs have centered on forecast collaboration as well as promotional aspects of joint planning. CPFR is designed to predict sales based on information provided relating to promotions or planned discounts. Out-of-stock situations often occur when consumer demand - sparked by retail promotions that may not have been communicated to the manufacturer - outstrips the supply chain’s ability to replenish. Conversely, unsalable inventory may result from non-existent or ineffective promotion of products that have been stocked based on anticipated demand forecasts that never materialize. This is particularly true for new products. By taking promotional plans into account when forecasting, many promotion-related product availability problems are avoided. CPFR utilizes promotion information in conjunction with historical consumption patterns, market intelligence, manufacturing constraints, and raw material availability. Data are made available to trading partners over the Internet. “Live sales data” allow for constant updating and management of inventory on a real-time basis (Frook, 1998).

It is anticipated that collaborative efforts will be extended to incorporate a wide range of new joint business processes between retailers and suppliers as the CPFR initiatives mature. However, CPFR is not for every business organization. The business must have sufficient volume, i.e. enough trading partners interested to make it economically feasible. For example, the investment required generally cannot be justified if only one or two retailer trading partners are to be included. Trading partners must also overcome reservations about sharing proprietary information (Staff, 1998).

Collaborative planning will also require extensive support in the form of Internet-based products and will necessitate major process changes within the businesses (Moad, 1997). Success of Internet-based operations relies on instantaneous movement of information from the customer to order planning and fulfillment and then back to customers with tracking and confirmation numbers. This entails total supply chain integration with real-time information sharing among supply chain entities. Achieving this level of secure information and process integration will require increased information technology sophistication all along the supply chain (Ruriani, 1998). The resource commitment and synchronization of systems to ensure data security and compatibility will continually present a challenge for implementation (Doherty, 1998; Saccomano, 1998). Typically, applications supporting operational processes belong to either the manufacturer or the retailer. Even though information may be passed between the two, the processes remain disjointed. The technology needed to link operating systems and to analyse and share data forecasts has either not existed or has been too costly to deploy. Recently, however, new software solutions, such as Syncra St, have been developed that enable multiple trading partners to collaborate by creating a common link through which different applications may communicate (Doherty, 1998).

Research areas

The preceding discussion of the literature led to the development of four research areas. The first area concerns the current levels of involvement in cross-organizational collaboration and program-related success to date among manufacturers and retailers engaged in automatic inventory replenishment programs. Research area two is related to performance inputs, exploring the association between high levels of CPFR and implementation of changes to operating processes. Research area three explores performance outcomes. It seeks to determine the association between CPFR and operational performance goals. The fourth research area pertains to the linkage between CPFR and information system capabilities. The research seeks to determine whether an association exists between high levels of CPFR implementation and heightened information system capabilities.

2.5 Cooperation or coercion ? Supplier networks and

relationships

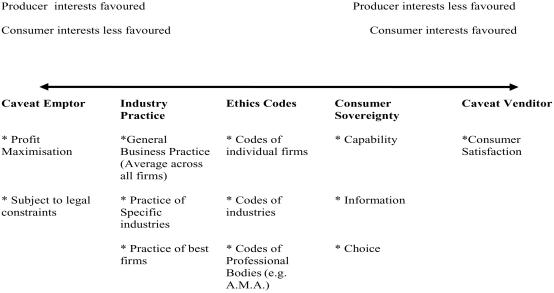

Tesco is considered a leader in fostering positive inter-organizational relationships with suppliers. In the fresh produce sector, for example, minimum prices are offered to suppliers in exchange for guaranteed supply levels and quality levels. Should the market price rise above the minimum price, farmers are apparently rewarded (Financial Times, 1995). The balance of power in these relationships, however, falls strongly into the hands of the retailers as one commentator has observed: "The power brokers in the modern food economy are the distributors. It isn't a market economy any more, it is a hyper-market economy" (Financial Times, 1995).

Although it is assumed from these comments that the supermarkets are leading the way in developing vertical relations in the food industry, it is still the case that these partnerships have not fully developed. As Fernie (1994) points out: "Despite much of the rhetoric about partnershipping, the practice of working closer together still has a long way to go”. This is clearly a key feature of the food industry that suggests that there is potential for unequal business relations to occur. As a senior retail manager states", We all want partnership so long as it is on our own terms (Ogbonna and Wilkinson 1996). This article is set within the context of these relationships and seeks to elicit ethical perspectives from the managers who are responsible for developing partnership initiatives, for managing within the legal and regulatory framework and, just as crucially, for filling an important gap in the supply chain which links raw materials, products and services with the general public.

Wong (1999), states that "Business partnering occurs through a pooling of resources in a trusting atmosphere focused on continuous, mutual improvement". Little evidence of this ideal was found in the transcripted data.

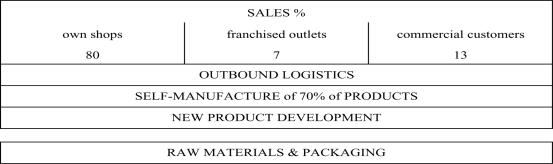

Thorntons: the vertically integrated retailer, questioning the strategy

A firm's ability to achieve and sustain competitive advantage can be seen as dependent on the development of the organization’s value chain and linkages with other parts of the value system (Porter, 1985, 1996). To what extent value creating activities need be retained in-house is increasingly open to question. The development of supply chains toward outsourcing and lean supply, has provided a revolution in the configuration of organizations and challenging the historically established practice of vertical integration (Quinn et al., 1990). With the result that competition may be better seen as a phenomena that occurs between supply chains rather than individual companies (Christopher, 1998; Hines and Rich, 1998).

Numerous competitive benefits have been proposed for the use of outside supply arrangements. These include: the conversion of fixed costs to variable costs; access to world-class quality, productivity and cost. For resource development the strategy has been seen as providing a means of redressing resource inadequacies and imbalances; improved access to functional expertise, increased resource leverage of the organization’s resources through the use of supplier's and partner's assets and the avoidance of seasonal and cyclical excesses in capacity and inventory. For the management of the organization the reduction in functional areas may provide simpler and less bureaucratic organizational forms with increased focus for strategy, investment and development. The organization's ability to respond to a changing environment may also be enhanced by facilitating changes in volume and type of output, and through providing enhanced opportunities for learning through interactions with supply partners, and lower risk through reduced investment. (Blumberg, 1998; Lonsdale and Cox, 1998; Nishiguchi and Brookfield, 1997; Lamming, 1993; Snow et al., 1992; Venkatesan, 1992; Quinn et al., 1990).

This paper examines the implications for competitiveness and strategic development of an in-house approach to operations that combines manufacturing and retailing. A model is developed for the make-or-buy decision and through the use of case material used to discuss the experience of a particular company, Thorntons, a vertically integrated confectionery retailer.

Questioning the dominant paradigm

While the use of outside supply presents the potential for achieving a wide range of strategically significant benefits, survey evidence suggests that the majority of managers are dissatisfied with the outcome of their outsourcing decisions (Lonsdale, 1999).

The leakage of core knowledge may lead to the emergence of new competitors (McIvor et al., 1997; Preece, 1995; Welch and Nayak, 1992; Hamel et al., 1989). Dependence on suppliers may lead to opportunism (Lonsdale, 1999; Ford et al., 1998). Critical activities may become inadvertently outsourced through an over focus upon cost and quality aspects of the outsourcing decision leading incrementally to a loss of the firm's capability (Bettis et al., 1992). A process that may be facilitated by a lack of senior management guidance for make-or-buy decisions (Ford et al., 1993). Care needs to be taken when outsourcing to avoid contracting-out elements of the business that differentiate the firm in the market place (Bruck, 1995). However, in large part, such dangers can be seen as a consequence of how the outsourcing decision is evaluated rather than intrinsic to the use of outside supply.

Cox (1999a) points to the emergence of a dominant paradigm in current writing about supply chain management, based upon lean thinking and the attempt to replicate for a variety of product and service supply chains Toyota's lean approach to resource management. While this model has been appropriate for a number of industry situations its applicability for all companies is questioned. There is a need to recognize "the key strategic decision within the company's the make-buy decision" (Cox, 1999a, p. 169).

Different conclusions can be expected from that decision both between industries (van Hoek, 1999) and for firms within an industry (Blumberg, 1998). Cox (1999b) emphasizes that supply chain decisions need to be seen as contingent on specific market circumstances. Similarly Fisher (1997) indicates the need to recognize choice in devising a supply chain strategy based upon the differing requirements posed by product characteristics.

UK retailing provides a number of examples of companies, which to a varying degree, employ an in-house supply strategy, often the strategy is seen as contributing towards product differentiation. For Boots Contract Manufacturing 60 per cent of its sales are to customers within the Boots group, accounting for 3 per cent of sales for Boots the Chemists. The in-house operation is justified by its providing "innovative, market-focused and differentiated products" (1999 Company Report). A similar justification is presented by W.H. Smith where the acquisition of Hodder Headline is explained as part of responding to the “need to differentiate ourselves” through the use of Hodder's existing back catalogue and the development of materials for W.H. Smith’s stores (1999 Company Report). The fantasy game retailer Games Workshop demonstrates a greater reliance on in-house operations. The company's in-house design, in-house manufacture of all metal miniatures (50 per cent of sales) and ownership of own stores (40 per cent of sales) provide numerous opportunities to develop and differentiate their product/service.

The in-house strategy may need to be reconsidered as circumstances change. The Body Shop developed through in-house manufacture together with a retail network based on franchising and sub-franchising, with control of ingredients and manufacturing processes helping to differentiate the company’s products in addressing the environmentally orientated consumer (Campbell, 1998). By 1999, faced with deteriorating commercial performance, the company attempted to focus more effectively on its priorities as a retail organization, combining a move to company-owned shops with the use of outsourcing. The anticipated benefits of outside manufacture included access to greater external expertise and speed in product development. The outsourced UK manufacturing facilities had produced approximately 50 per cent of the products sold but on occasion had come to operate at only 25 per cent of capacity.

2.6 The make-or-buy decision: a contextual model

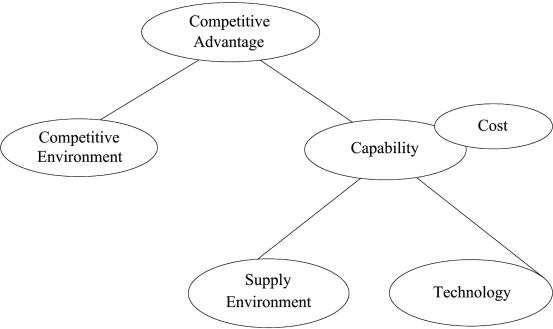

A wide literature is available concerning factors influencing the decision to provide an activity in-house or through outside supply. The model provided in Figure 2 The make-or-buy decision presents the make-or-buy decision as a complex, strategically orientated decision that focuses on the decisions consequences for competitive advantage, with competitive advantage being based on a matching of capability to competitive environment (Kay, 1993; Hofer and Schendel, 1978).

|

Figure

2: The make-or-buy decision

Competitive environment

An organization's sourcing strategy needs to be consistent with competitive conditions and the development of competitive advantage (Quinn and Hilmer, 1994; Harrigan, 1986). Sourcing decisions must support the business strategy and may have to be revised as competitive condition's change. Competitive developments may bring into question the relevance of capabilities and assets that have been seen as core for the organization. Through industry evolution the processes of buyer learning, diffusion of proprietary knowledge, process and market innovation and experience, all serve to change the competitive emphasis and the potential for particular value chain activities to contribute to profitability.

The level of environmental uncertainty may also affect the sourcing decision. Uncertainty may provide a motive for vertical integration by limiting the ability to define contracts (Hobbs, 1996). Harrigan's (1985) study concluded that uncertainty concerning final product demand and volatile competition can mitigate the advantages of in-house investment through presenting the risk of over-capacity. However Lieberman's (1991) study did not support the view that backward integration is discouraged by volatility in downstream demand, rather integration was addressed to variability in the input market.

Capability

Within the resource-based view of the firm, resources and capabilities are seen as the foundation for the firm’s long term strategy and profit (Grant, 1991). The core activities of a business are essential parts of its capability, the set of business processes that consistently provide superior value (Stalk et al., 1992). In addressing the issue of strategic outsourcing, Quinn and Hilmer (1994) emphasized the need for the organization to concentrate its resources on a set of core competencies where it can achieve definable pre-eminence and provide unique values for customers strategically outsourcing other activities, including many traditionally considered integral to the company (Quinn and Hilmer, 1994, p. 43).

The application of this argument is far from straightforward. There are difficulties in identifying the core activities of an organization (Javidan, 1998; McIvor et al., 1997; Venkatesan, 1992). An example can be found within the financial services industry where the core activities have been variously defined as those concerning the information system, the product development process and the distribution system. Each definition opens up the possibility of very different outsourcing strategies.

Core capabilities need to be unique, important, controllable, durable and able to generate excess profit (Schoemaker, 1992). They do not necessarily have to be wholly owned. However such capabilities do require a seamless integration of activities. When considering the outsourcing of near to core activities great care must be taken to ensure that the essential relationships that underpin the creation of value will remain available and can be maintained and developed. Such relationships can be successfully built across organizations, providing the opportunity to achieve increased learning (Lamming, 1993). Such integration is achieved through information exchange, not necessarily ownership (Christopher, 1998; Richardson, 1996).

Cost

Short term cost reduction has often been the predominant criteria adopted by firms in assessing sourcing decisions (Ford et al., 1993). The evaluation of cost requires a comprehensive identification of variable and overhead costs and the implicit costs concerning the alternative use of released resources. The analysis needs to encompass all of the costs associated with the acquisition of the activity throughout the entire supply chain, from idea conception to any costs incurred during use by the final customer (McIvor et al., 1997).

While a decision that demonstrates cost and headcount reductions may be welcomed by senior executives (Greer et al., 1999) care has to be taken in identifying the cost drivers (Porter, 1985) possessed by potential suppliers that will enable them to provide and sustain superior cost performance.

On occasion in-house supply, vertical integration, can provide lower costs (D'Aveni and Ravenscraft, 1994). Large organizations may find prospective suppliers unable to match their own internal economies of scale and many specialist suppliers may have an effective scale that is no greater than that of their customers (Alexander and Young, 1996). Even if outside suppliers possess greater efficiency, cost savings may not be obtainable when a few vendors dominate a specialized market (Greer et al., 1999).

Technology

For a business to develop and sustain competitive advantage requires access to one or more technologies and the ability to benefit from, or even lead, the development of relevant technologies. The development of technology can be expensive, consequently the decision as to which technologies should be developed in-house must be made on a selective basis that ensures support for sustaining competitive advantage.

Guidelines for evaluating the outsourcing of technologies have been considered by Welch and Nayak (1992) and also Blumberg (1998). Both authors emphasize the need to consider the rate of technological change. A technology’s maturity implies little potential for improving advantage and the possibility of a broad range of potential outside suppliers. Alternatively technological change may occur at a faster rate than the firm can sustain internally. Additional factors for consideration include, the relevance of the technology for the firm’s competitive advantage and the company's relative technological performance, it is unlikely that a firm which is lagging in a technology can move to a position of leadership.

Supply environment

Outside supply can be based on a range of relationships from arm's length contracting through to long term relationships based upon partnership, with the separate roles of customer and supplier being replaced by the acceptance of "mutual destiny by neighbors in the supply chain" (Lamming, 1996, p. 187). Such supply chains may act to reduce waste throughout the chain, improve flexibility and learning.

However the supply environment can also be problematic. Lonsdale (1999) warns of a lack of awareness of the dangers of outsourcing into a limited supply market, where few firms are capable of providing goods or services to the required standards or volume or in the required geographical area, opening the possibility of suppliers exploiting the situation. Similarly incomplete contracts, established to provide flexibility in an uncertain situation, may later become a basis for disagreement and opportunistic supplier behavior, when switching costs have become established and the incumbent supplier has acquired superior knowledge to that of other potential suppliers. Cox (1999a) re-asserts the strategic importance of value appropriation (Kay, 1993) in that there is a need for a proper understanding of the power structures that exist in supply chains before attempting to implement particular supply strategies.

Strategic decisions need to be evaluated against a long term perspective. For sourcing decisions that includes a consideration of longer term trends in the supply market, including concentration, and the switching costs that face the customer organization in the near, medium and longer term.

The service capability of suppliers and their financial strength must also be assessed to avoid supplier failure (Blumberg, 1998) as must their ability to understand the customer organization's goals, mission and culture as a basis for partnering.

2.7 Passing value to customers: on the power of

regulation in the industrial electricity supply chain

Mapping the supply chain

There are five key functional stages in the supply chain for industrial electricity. As shown in Figure 3 The industrial electricity supply chain: functional stages and key resources , these are the supply of a primary fuel source, generation, transmission, distribution, and supply.

Figure 3: The industrial electricity supply chain:

functional stages and key

resources

We will consider each of these stages in turn, discussing them in terms of the primary activities carried out at that stage, the resources needed for these activities, and the major firms operating at a particular stage.

Primary fuel

The primary fuel stage is perhaps the most complex to map descriptively, because there are a number of different supply markets operating here. These represent the six main types of fuel used to generate electricity in the UK, namely coal, nuclear, gas, renewables, coal and oil derivatives, and oil itself. There is, however, a single primary activity that is common to all of these fuel types. This can be defined as the capture/extraction and refining of a raw energy source followed by the delivery of that refined energy source to the generator. Again, the diversity of different fuel types means that the resources required by suppliers do vary somewhat. Nevertheless, the following three resources can be identified as common to the provision of all fuels. These are licensed access to specific sites, an expertise in finding and exploiting these sites as efficiently as possible, and an ability to provide a reliable supply of satisfactory quality.

Generation

The key activity at this stage is the conversion of a primary fuel source into electrical energy. This conversion involves a variety of plant types depending on the fuel used, but the fundamental process always includes the same steps. First, the fuel source is converted from potential energy to kinetic energy to drive turbines. Second, the motion of these turbines generates high voltage electrical energy.

Whatever the plant type in question, there are three resources that are essential to any firm operating at this stage in the supply chain. The first of these are the technical skills necessary to ensure an efficient use of fuel inputs and plant capacity so that the generator achieves the maximum electricity output for a given unit of fuel. A second and related resource is an expertise in repair and maintenance to minimize the time when a generating set is inoperable. In combination, these first two resources are vital if a generator is to achieve and maintain a low cost operation. The third key resource for a generator is access to suitable sites on which to build their power stations.

Transmission

This functional stage involves the bulk transfer of electrical energy along high voltage wires to localized distribution networks. The transmission network consists of pylons carrying overhead lines in rural areas, underground cables in more urbanized areas, and sub-stations connected to the regional distribution networks.

The key resources required to operate at this stage in the supply chain are threefold. First, an organization needs free access to the land on which the transmission network is based, so that it is able to perform vital repair and maintenance tasks. This does not mean, however, that the organization needs to own all of the land surrounding the network, simply that it should enjoy a right of unfettered access across land that is owned by a variety of private individuals and organizations. The second key resource is the technical skills necessary to ensure safe, reliable and efficient transmission. Finally, an organization needs a licence to operate granted by the state.

Distribution

The distribution function involves the transfer of high voltage electricity, drawn from access points in the transmission network, through a localized distribution network which reduces the voltage and which provides a connection to the premises of the end customer. The localized distribution network consists of overhead lines in rural areas, underground cables in urban areas, and a number of sub-stations operating at successively lower voltages. The key resources required for efficient and effective operation at this stage are the same as those required in the transmission stage, namely open land access, the right technical skills, and a licence to operate.

Supply

This is the final functional stage in the electricity supply chain. It involves the bulk purchase of electricity from generators and its sale to end-users. Electricity is bought in one of two ways: either from the Pool or, more commonly, under a direct contract with a generator. This is essentially a trading activity backed up by meter reading, billing, and collection of customer payments. Supply companies are also increasingly offering their industrial customer's value added in the form of energy management services. This is a response to the significant levels of competition that have developed at this stage in the chain following the phased liberalization of the 1MW+ segment (1990) and the 100kW+ segment (1994) (OFFER, 1998h).

Given these conditions of open competition in what is a commodity market, there are four key resources required by a firm at this stage in the chain. The first is an efficient and secure system for collecting and managing customer information. The second resource is a combination of good negotiation and contract management skills to win and retain customers and to purchase electricity at favorable prices. Third, a firm needs an in-depth understanding of customer needs and wants. Finally, the firm needs a good reputation and a strong brand identity, because the product itself cannot be a basis for differentiation

The strategy of vertical integration has implications for management's ability to identify core capabilities, with the possibility that the company may fail to adequately recognize and develop the necessary core activities. The wide range of activities associated with being both a manufacturer and a retailer can be seen as facing Thorntons with difficulties in focusing their development. In the interviews and through their public statements Thorntons's directors clearly stated that the company was primarily a retailer but for a prolonged part of the company's history that focus was not apparent. In the mid 1980s the company made considerable investment in the improvement of shop appearance, but acknowledged that for the following ten years the appearance of the shops had tended to be neglected.

2.8 Green supply chain

Green approaches

Despite the fact that categorizations of green approaches are being criticized for their broad nature, they do have something to say. Fundamentals of greening as a competitive initiative were explained in detail by Porter and van der Linde (1995). Their basic reasoning is that investments in greening can be resource saving, waste eliminating and productivity improving. As a result, green initiatives can lower not only the environmental impact of a business but also raise efficiency, possibly creating major competitive advantages in innovation and operations.

Kopicki et al. (1993) introduced three approaches in environmental management: the reactive, proactive and value-seeking approach. In the reactive approach companies commit minimal resources to environmental management as they start to procure some products with some recycled content, start labeling products that are recyclable and use filters to lower the environmental impact of production. However, filters are an "end of pipeline" initiative used to comply with environmental legislation that do not take away any of the causes of the environmental impact. In the proactive approach, companies start to pre-empt new environmental laws by realizing a modest resource commitment to initiate the recycling of products and designing green products. In this approach the company assumes responsibility over product re-use and recycling as an element of environmental management. The most far-reaching approach is value-seeking, in that companies integrate environmental activities into a business strategy and operate the firm to reduce its impact on the environment as a strategic initiative. The CEO establishes a strong environmental commitment and the capital commitment is shared among partners in the supply chain. Operating systems in the value-seeking phase may include the (re-) design of products for dis-assembly, the use of life-cycle analysis and creating an involvement of third parties. In this approach environmental management assumes supply chain wide responsibility as opposed to ad hoc and fragmented organization (generation one) or functional silo organization (generation two).

Walton et al. (1998) use a comparable three phase model that starts with "comply with the letter of the law" (reactive) and goes from "clean up" to proactive. Despite the fact that Kopicki et al. (1993) use the proactive phase as a second phase the explanation of the proactive approach provided by Walton et al. (1998) is comparable to that of the value-seeking phase of Kopicki et al. (1993). Companies are integrating environmental management into corporate strategic planning and into day-to-day processes as they adopt a resource-productivity framework to maximize benefits attained from environmental programs.

The extension of the Kopicki et al. (1993) framework offered by Walton et al. (1998) is that they state that companies will only thrive in the final phase of environmental management when they act as a whole system that includes customers, suppliers and other players in the supply chain. By explicitly developing a supply chain approach in the environmental management process, the impact on operations is leveraged throughout the chain, expanding the domain to a much wider arena. They detail how such an approach requires that cross-functional and cross-company processes are addressed, including product design, supplier's processes, evaluation systems and inbound logistics. Of course, this approach requires a much more far-reaching effort of players in the supply chain and larger investments than those in filters. This indicates the need for a strategic approach and in-depth development of opportunities. Walley and Whitehead (1994) also mention the value-based approach as the most far-reaching approach in environmental management. They characterize this approach as systematic, through the strong commitment and integration of flexible strategies and structures, throughout the supply chain. Flexibility relates to the ability to exercise different options, applied in the Recap project through the development of various new channel structures depending on the type of application of recycled material. Within this approach three types of activities are undertaken: operational, technical and strategic activities, depending on the impact on value and the scope of discretionary response. Hart (1997) introduced the distinction between today’s greening efforts and tomorrow's targets, internal and external efforts. The difference between today’s efforts and tomorrow’s targets appears to be relatively similar to the scope of discretionary response, the external dimension meets the supply chain approach. Table II Management approaches to greening lists the characteristics of the three approaches.

Table II Management approaches to greening lists the characteristics of the three approaches.

Green steps to take

If a supply chain approach is so important in a value-seeking greening initiative, how should businesses develop such an approach? Figure 4 highlights some of the changes needed in the evolution from reversed logistics to green supply chains. First, this evolution fits within a move away from reactive approaches oriented at complying with regulation to a more far-reaching attempt to seek value, proactively and gain competitiveness, as explained in the previous section. The perspective then changes from greening as a burden to greening as a potential source of competitiveness. Such competitiveness may be based on:

·creating a marketing edge by using greening as a unique selling point with environmentally conscious customers;

·leveraging innovation. Design for dis-assembly for example, can be based on smart product connectors which are easier to (dis-)assemble, lowering assembly lead-times; or

·cost-savings

realized through resource-savings. Using less fuel for example, by lowering

trucking miles, not only lowers emissions but also saves on fuel expenses and

drivers’ working hours.

Figure 4: The changes needed in the evolution from

reversed logistics to green supply chains.

The scope of actions in the chain has to change from an initial sale to that of the entire product usage life-time, not only because of environmental impact during its use (instead of during production and distribution only) but also because of the future return flow. Some companies, like MCC (a wholly owned Mercedes company) that makes the new Smart car, are already experimenting with this concept. Establishing a relationship with customers is used to facilitate customer loyalty and follow up orders. Smart uses product upgrades and adjustments (e.g. different coloured door panels etc.) as a carrier for the enduring customer contact (see also: van Hoek and Weken, 1998). During the life of the car (the use by a customer) clients can have the car adjusted to changing needs with add-on modules and even new body panels. As a result the product's life cycle can be extended and waste volume can be lowered; only modules are abolished not entire cars. Why not use these initiatives to expand the scope of actions beyond its initial life into a second and third life, while raising customer loyalty and raising the number of repeat orders? The related solutions to greening are thus more reduce and re-use initiatives than end-of-pipeline solutions. The latter do not take away the cause of emissions, they just filter the emission after the occurrence. If we really look at greening opportunities throughout the supply chain we can address environmental impact right at the source and throughout the process and migrate from low-end solutions to solutions far higher in the greening hierarchy, with a far more significant impact on greening (see Figure 5). Again the scope of greening initiatives then moves beyond individual companies to the supply chain. The question then becomes how to re-define Figure 4.

Figure

5: the greening hierarchy with a far more significant impact on greening

Green supply chains to make

Table III Players, activities and evaluation of greening efforts throughout the supply chain provides an attempt to redefine the context and scope of greening initiatives in the supply chain. First of all, the supply chain involves multiple players. The first row lists a number of them, reaching as far as raw material suppliers and retailers. All of these players can play an important role in greening the supply chain. In the downstream stages products are taken back into circulation after their initial life cycles. These are then scrapped, shredded and dis-assembled in the midstream stages by manufacturers and main suppliers. The suppliers in the upstream stages can then recycle and re-use the parts and modules. In the initial production, materials are to be selected upstream, the design for assembly used midstream has to favor dis-assembly and transportation and packaging downstream has to be environmentally conscious.

Table III Players,

activities and evaluation of greening efforts throughout the supply chain

If a supply chain is to really assume responsibility over its ecologic footprint it is to be evaluated on these grounds. The supply chain footprint has to be measured against different indicators than the original footprint measure. In that respect, a set of performance measures relevant for these activities is identified and listed in the final row of Table III. Materials can be selected against emission rate and energy consumption standards. Re-use of materials can be measured against the percentage of "virgin" or new materials used in parts production. Ideally, this percentage should be as low as possible. Dis-assembly and shredding can be measured as volume of goods handled per time unit. Transportation can be assessed in terms of loads against capacity of transport equipment. A high degree of utilization is an indicator of the efficiency of transportation. Driving empty trucks around creates emissions without economic value. Packaging cannot only be evaluated based on packaging material used but also by the amount of air or useless space in the package. Returns handling can be measured in terms of volumes handled to indicate the size of the operation. More important is the volume selected for recycling/entering the re-use supply chain, as this provides an indication of the effectiveness of the return flow of goods and the value of products returned.

2.9 Satisficing dependent customers: on the power of

suppliers in IT

systems

integration supply chains

Key stages in the supply chain

Each of the key functional stages in the systems integration

supply chain is described below (Figure 6).

Figure

6: The power of suppliers in IT systems integration supply chains

The end customer