Author: Chen

Der-Fu

Candidate of

Doctor of Business Administration

International

Graduate School of management, National University of South Australia

Email: teacher2001@ms52.url.com.tw

Abstract

Wroe Alderson, the father of modern marketing

thought, described marketing channel as ecological system. Alderson offered this

description because of the unique, ecological-like, connections that exist among

the participants within a marketing channel. The organizations and persons

involved in channel flows must be ‘sufficiently connected to permit the system

to operate as a whole, but the bond they share must be loose enough to allow for

components to be replaced or added’.

The collective and common goals for marketing

channel are customer (market) value creation, the concept of value creation

infers a high degree of cooperation and coordination between customers and their

suppliers, close relationships between them have revolutionized marketing

channels in two ways:

1.

Close

relationships emphasize a long-term, win-win exchange relationship based on

mutual trust between customers and their suppliers.

2.

They

reinforce the relationship dimension of exchange that is at the heart of

marketing.

The progression of marketing channels through a

production to a relationship approach has been fostered by the evolving

contributions channel intermediaries have made toward the creation of customer

value (market value).

As much of the developed world faces a recessionary

tide, age-old questions on the nature of creating and sustaining lasting market

value are once again being asked. In the past, questions of market value

creation were answered by investing in tangible assets. Today, those same

questions are being answered by investing in intangible assets. Intangible

assets, such as knowledge, patents, organizational structure, copyrights,

information technology, business processes and brand, among others, now

constitute the majority of value created by firms today. However, ultimately,

businesses are made up of a network of relationships: relationships with

customers, employees, suppliers and partners. These "relationship

assets" constitute a firm's most valuable store of capital and their most

important intangible assets. The ability to create and sustain maximum market

value, therefore, requires a focused set of twenty-first century management

rules. Rules focused on intangible, relationship asset leverage.

In measuring

a firm's ability to build and sustain value creation, one could certainly point

to a firm's ability to leverage its core capabilities over a long period of

time, to a firm's ability to innovate around products or services, or to a

firm's competitive position in its industry. One could even point to a firm's

ability to move quickly in constantly changing markets. We believe, however,

that revenue growth and earnings ultimately come from customers, not products or

services, or even core business capabilities. Furthermore, we believe that a

value-driven ecosystem of employees, suppliers and partners is the

"core", sustainable business asset necessary to capture customers and

their lifetime value - and to generate net future opportunities that will

sustain revenue and net income growth.

Keywords:

Relationship, Marketing Channel, Knowledge, CRM, Core capabilities,

Internal Marketing, IT

To achieve success in a competitive arena, members

of relay teams must pool individual resources to achieve collective goals

through a connected system. In addition, this connected system must be flexible

enough to accommodate changes in the environment. Similarly, for marketing

channels to succeed in a competitive marketplace, independent marketing

organizations must combine their resources to pursue common goals. Wroe

Alderson, the father of modern marketing thought, described marketing channel as

ecological system. Alderson offered this description because of the unique,

ecological-like, connections that exist among the participants within a

marketing channel. The organizations and persons involved in channel flows must

be ‘sufficiently connected to permit the system to operate as a whole, but the

bond they share must be loose enough to allow for components to be replaced or

added’.

Lately, the

industries in Taiwan have seen extreme volatility. Many industry sectors are

again enduring painful layoffs. Warnings of slowing earnings and revenue growth

abound. The indicators of a slowing economy have been evident for some time.

Even the fear of a prolonged recession - and possible depression - is on nearly

everyone's mind. In the midst of such turmoil - only heightened by the fact that

the Taiwan economy is coming off its most prosperous period of growth in history

- fear, uncertainty and doubt reign supreme. Additionally, paranoia and deep

concern of a global recession run high. In a period of slowdown and weakness,

the age-old question is once again begged: How is market value created and

sustained? Certainly, recent moves by many firms reflect short-term survival

tactics. Furthermore, many sectors have seen massive value destruction (in the

form of market capitalization loss) over the last several months, and along with

that, individual investors have also seen severe wealth destruction. In spite of

current conditions, firms would do well not to take their eyes off a long-term

view - off the long-term strategies needed to create and sustain market value -

even in such a period of seeming global economic slowdown and market

instability.

In order to

keep a firm focused on long-term value creation - its net future opportunities -

effective management is essential. In order to manage for value creation, one

must first understand what constitutes value. But what constitutes

value is changing, and the rules of value creation have changed in the

twenty-first century.

The progression of marketing channels through a

production to a relationship approach has been fostered by the evolving

contributions channel intermediaries have made toward the creation of customer

value (market value).

Determining

company value used to be a straightforward process. Chief financial officers,

controllers and accountants painstakingly tracked their business's assets -

items such as property, plant, equipment, machinery and inventories.

Historically, these assets constituted the bulk of what contributes to a firm's

overall value. They could easily be measured and utilized to calculate a return

on investment, as well as easily reported from an accounting perspective. Over

the last several years, however, increasing discrepancies of what determines a

firm's market value have emerged. Arguably, for decades, public markets have

valued firms by the sum total of corporate assets (or tangible assets) that can

be measured through 500-year-old accounting rules and practices. However, the

rules that govern market value have clearly changed.

Many pundits

have argued that with the rise of the "information age", knowledge

became the most valuable corporate assets. However, as knowledge rose in

importance, the ability to measure and account for its value proved elusive.

Nonetheless, knowledge and other "invisible" or "intangible"

assets heavily influence the value-creating process. As such, the last ten to 15

years have seen the rise of intellectual capital - company components such as

trademarks, patents, copyrights and even the tacit knowledge of employees - as

the key determinant of market value. Today, it is quite common for companies to

be valued at more than the sum of their net, or book assets, precisely because

of these intangible components.

In terms of

market-to-book ratio gaps, we can highlight examples from the past and the

present. In 1986, Merck had the biggest gap: its book assets covered just 12.3

per cent of its market value; in 1996, Coca-Cola's book assets were only 4 per

cent of its value, whereas the same figure for Microsoft was 6 per cent; in

2001, even depressed Internet leader Cisco Systems' book assets cover only 25

per cent of its market value, while stalwart GE has book assets covering 10 per

cent of its market value. The examples go on and on. At the same time, some

companies are trading below book value, which might suggest the existence of

"intangible liabilities" (Harvey and Lusch, 1999). Interestingly,

market capitalization has now widely become an important corporate objective,

both to drive perceptions of economic success and to help firms achieve their

strategic goals. Market capitalization is used as a metric for corporate

performance, not just current performance, but more importantly, future

expectations. And the future expectations mantra doesn't just apply to

US-based firms, but also in Asia and Taiwan.

One can

deduce from this trend that building future expectations of growth is becoming

more important and relevant for active value management, and we argue that

managing and maximizing intangible assets is the key driver of these future

growth expectations. However, few firms have systematically begun this process.

Ernst & Young consultants Cambell and Knoess (2000), in a recent industry

white paper, reveal the following:

Tangible

assets amount to just a fraction of the value of the S&P 500 companies. In

fact, less than 25 per cent of their market capitalization is backed by cash

flows to be derived over the next five years, even though most of these

companies admit their planning horizon is far shorter than that. More than 75

per cent of their value must be derived from cash flows far into the future, for

which most cannot specify business plans or management goals, not to mention

budgets or operational plans.

Logically,

it stands to reason that firms must tie strategic energy and vision, allocation

of resources and operational objectives to their intangible assets in order to

drive future growth expectations. But just where do future growth expectations -

and sustained market value - come from?

Where did

the revenue growth and earnings come from? What generated future growth

expectations? According to the Bain study, revenue growth and earnings came from

businesses that focused on growing their profitable, core businesses while

subsequently driving that competitive advantage into areas adjacent to the core.

The assumption we can draw from Bain's study is that firms create net future

expectations by maximizing their core capabilities, over time, while leveraging

adjacent market opportunities for sustainable revenue and income growth.

In measuring

a firm's ability to build and sustain value creation, one could certainly point

to a firm's ability to leverage its core capabilities over a long period of

time, to a firm's ability to innovate around products or services, or to a

firm's competitive position in its industry. One could even point to a firm's

ability to move quickly in constantly changing markets. We believe, however,

that revenue growth and earnings ultimately come from customers, not products or

services, or even core business capabilities. Furthermore, we believe that a

value-driven ecosystem of employees, suppliers and partners is the

"core", sustainable business asset necessary to capture customers and

their lifetime value - and to generate net future opportunities that will

sustain revenue and net income growth. But these assets are not tangible; they

are intangible.

Ultimately,

revenue and net income growth come from a firm's relationships - customer,

employee, supplier and partner relationships that affect the firm's ability to

maximize and grow those customers. While intellectual capital, or intangible

assets, such as trademarks, patents and copyrights may improve the probability

of future growth expectations, customers still choose whether to buy a

firm's products and services. The value of relationships, including customers,

employees, suppliers and partners, is the key predictor of a firm's net future

expectations.

Given our

premise that premium valuation in the market comes from intangible asset value -

the primary driver of any company's future value according to Lev (2001), Philip

Bardes professor of accounting and finance at the Stern School of Business, New

York University - the recent market volatility should not distract the

responsible company from focusing on long-term value creation, regardless of

whether the company might have taken a recent 30-plus per cent hit in its market

capitalization.

The reality

is that competitive survival and success will depend on smart intangible

investments in the twenty-first century. Economic slowdowns and capital market

declines do not change these fundamentals. In order to maximize net future

opportunities, firms would be wise to focus on the most important of intangible

assets, their relationship assets. Maximizing and managing relationship assets -

the new rules of value creation - are essential for a firm's performance in a

new economic era.

Firms do not

exist in isolation. Strategies are first created to identify attractive market

segments to enter, customers to target and products or services that need

developed and sold to generate revenue and profit. Suppliers are a necessary

component of the value chain to build a product or service. Employees are needed

to tackle a whole host of issues including:

| managing

organizational efficiency; | |

| deploying

and maintaining all types of information technology; | |

| providing

research and development expertise; | |

| acting

as marketing and selling agents; | |

| providing

customer service; and even | |

| providing

general and administrative support. |

Partners are

needed to distribute and sell, or are leveraged to outsource and manage

components of a firm's business. And, of course, customers are needed to

purchase (initially and repeatedly) the product or service - either directly or

indirectly - that the firm offers. What becomes easily apparent is that the

firm's success is ultimately derived from relationships, both internal and

external. To manage the turbulent waters effectively as we enter a new century

on a note of uncertainty, we must understand that relationship assets are the

most valuable store of any firm's capital. Jeremy Galbreath (2002) submitted a

new order of management rules, or at least an enlightened focus on existing

ones, is in order.

Quality

management guru and author K.R. Bhote (1996) summarizes this research:

| Finding

new customers costs five to seven more times than retaining current

customers. | |

| Reducing

customer defection by 5 per cent can increase profit between 30 and 85 per

cent. | |

| Increasing

customer retention by 2 per cent equals cutting operating expenses by 10 per

cent. |

Furthermore,

Bhote (1996) uncovers the following sobering facts about customer relationships:

| Of

customers who say they are "satisfied" 15 to 40 per cent defect

from a company each year. | |

| Of

dissatisfied customers 98 per cent never complain; they just switch to other

competitors. | |

| "Totally

satisfied" customers are six times more likely than

"satisfied" customers to repurchase a company's products over a

span of one to two years. |

Cost and

revenue factors must be appropriately associated with customer assets, just as

they are with traditional, tangible assets.

Interestingly,

in their 1997 book Customer Connections, consultants and authors

Wayland and Cole discovered that the vast majority (greater than 70 per cent) of

Fortune 1,000 firms have not identified their most valuable customer

relationships. These firms and others that do not understand or recognize their

most valuable customer relationships are vulnerable to lost financial and market

rewards.

The

groundbreaking research of Reichheld and Sasser (1990) sheds light on the

financial impact of customer relationships. There are associated costs to

acquire, to maintain the relationship with and to lose a customer. What

Reichheld and Sasser (1990) found was that, across industries, a firm loses

money acquiring a customer and does not see a financial return until later

years, sometimes as many as two to three years, a firm must maintain

relationships with the right customer base over time and accelerate their

purchasing frequency to generate profits (it costs five to seven times more to

acquire than retain). and, retention and loyalty are key predictors of

operational success (a 2 per cent increase in retention rates can cut operating

expenses by 10 per cent). To achieve the loyalty effect, firms must learn and

apply the mathematics and economics behind the measurement and management of

their customer assets.

Survey after

survey reveals that most businesses - most CEOs - are placing significant

attention on customer satisfaction today. In fact, a Juran Institute study found

the following: a full 90 per cent of the top managers in the study were

convinced that maximizing customer satisfaction maximizes profitability and

market share (Bhote, 1996). Contrary to common logic, customer satisfaction does

not necessarily equate to loyal or profitable customers. The reality is merely

"satisfied" implies the customer is sitting at the point of

indifference. Interestingly, the correlation between customer satisfaction and

customer loyalty is very weak. A high customer satisfaction rating is no

predictor of customer loyalty. By contrast, there is a very strong correlation

between customer loyalty, as measured by retention rates, and a firm's

profitability.

The point

here is that customers should be valued as strategic assets, whether or not they

show up on the balance sheet. Managing for customer loyalty will return great

rewards, namely long-lasting relationships where value exchange is high on both

sides and resultant market value creation is assured.

A firm's

employees constitute one of its most critical assets. In the 1999 edition of

PricewaterhouseCooper's annual report, Inside the Mind of the CEO, CEOs

from 19 countries in Asia, Europe, Latin America and North America discussed a

multitude of competitive, technological and management issues. However, when

asked to describe the key asset to competitive advantage in the next ten years

as compared to the present, the number-one response was the same: outstanding

people. Here are a few of the comments from the 1999 report

(PricewaterhouseCooper, 1999, p. 17):

Managing

people in a modern way will be most important - stimulating and empowering them

to act on their own. Another key challenge will be making correct decisions in a

shorter time frame (CEO from Argentina).

People will

always be people. However, despite how much technology changes, people will

remain the most important asset (CEO from France).

Not much

will change. People will be the principal challenge for management - as they

have been for the last three thousand years (CEO from the USA).

Given the

multitude of assets necessary to drive a firm's economic value, one key asset

remains the same: people. A firm's employees will continue to remain fundamental

to economic growth. In a recent edition of Management Review, the

results of a Deloitte & Touche survey of 400 top executives revealed that

two out of three respondents believe attracting and retaining qualified workers

will become increasingly difficult by 2005, as compared to today

(Comeau-Kirschner, 1998). Employees do have significant impact on a firm's

outcome, especially the firm's market value. How a business finds, develops and

retains them is a fundamental management challenge for competing in an era where

intangible assets, such as employees, constitute the majority of a firm's value.

Finally,

firms must pay closer attention to the economic value of its employees within

the context of their relationship assets. While the associated economic value of

customers is becoming refined through newer economic models and analysis tools,

employee value, outside of pure sales professionals, is proving more elusive to

measure. However, a recent report found that companies with employee turnover of

10 per cent or less have as much as a 10 per cent customer retention rate

advantage over a company with employee turnover of 15 per cent or more

(Comeau-Kirschner, 1998). This difference is a clear, measurable bottom-line

advantage when taken in context of customer retention and operating expense

reductions. Additionally, it is estimated that over US $1 trillion in market

capitalization is being lost in four high turnover industries due to stock price

and operating earnings reductions from the costs associated with employee

turnover (Sibson & Company, 2000).

Furthermore,

for leveraging employees relationships assets, we should implement internal

relationship marketing strategy for knowledge renewal and to increase customers

satisfaction.

More

recently, taking a relationship marketing perspective, Ballantyne et al.

(1995) seek to legitimise internal marketing, not by its methods but by its

purpose, which for them is to channel staff commitment and team-work into

market-orientated problem solving and opportunity seeking. They offered the

following definition:

Internal

marketing is any form of marketing within an organization which focuses staff

attention on the internal activities that need to be changed in order to enhance

external marketplace performance (p. 15).

Ahmed and

Rafiq (1995) express a contrary view. They seek to avoid task and functional

ambiguity by setting methodological boundaries for internal marketing. They do

this by proposing a multi-stage schema built around the 4Ps with three strategic

levels (direction, path, and action). In limiting the range of the internal

marketing "tool-box", they are seeking a return to marketing-like

methods (1995, p. 34). The irony is that this was a phrase earlier used by Gro

roos (1990, p. 223) in an attempt to create more (not less) developmental

latitude. Groroos (1990, p.152) makes his holistic intent clear:

Total

management of marketing has to be an integral part of overall management ...

market-oriented management is what it's all about.

Finally,

Varey (1995) offers a holistic model for market-oriented management that permits

a variety of internal change management approaches to enhance the operation of

the model. He sets few limits on the range of means for achieving

market-orientated ends, subject to collaboration through internal alliances.

My analysis

of the literature leads me strongly to this conclusion: The common denominator

in all internal marketing perspectives is knowledge renewal. This may seem a

surprising claim on the surface but I arrive at this focus simply by reframing

the evidence. By knowledge renewal, I mean generating and circulating new

knowledge. This could involve, for example, market intelligence made usable as

an organizational resource by capable employees who can define and share its

meaning with others. "Staff satisfaction", in this reframing, becomes

a possible indicator of the process of internal marketing in action rather than

its goal. Whatever methods are used, the goal is to enhance the customer

consciousness of employees, or customer perceived performance, or, more broadly,

stakeholder value.

From this

analysis, two methods for internal marketing emerge. The methods of internal

marketing are aligned either:

1.

With transactional marketing (aiming to satisfy customers' needs profitably); or

2.

With relationship marketing (aiming to create mutual value with customers or

other stakeholders).

In each case

the marketing methods are turned inward. However, from the literature, it is

transactional marketing that embraces 4Ps didactic methods, whereas relationship

marketing embraces more collaborative approaches. Thus, with internal

relationship marketing, the disciplinary origin of particular "tool

box" methods is less likely to become a territorial issue.

Reframing

internal marketing this way, I have developed a 4-square matrix of internal

marketing activity (see Figure

1). The dimensions of this are:

(Monological

methods - limited two-way interactions):

1

To capture new knowledge (measure and control data with guidance from a

"select few" staff and supported possibly by information technology);

2

To codify knowledge (promulgation of new product information, policy and

procedures, etc.)

(Dialogical

methods - open two-way interactions):

3

To generate new knowledge (cross-functional project groups, creative approaches,

innovation centres, quality improvement teams, etc.);

4

To circulate knowledge (team-based learning programmes, skills development

workshops, feedback loops, etc.)

The purpose

of internal relationship marketing is knowledge renewal and this takes two

discrete forms. The first is knowledge generation, meaning the creation or

discovery of new knowledge for use within the organization, with external market

intelligence as inputs. The second is knowledge circulation, representing the

diffusion of knowledge to all that can benefit, through the chain of internal

customers to external customers.

As I have

argued elsewhere, dialogue and generating new organizational knowledge are two

sides of the same coin (Ballantyne, 1999). However, Dixon (1999, p. 7) cautions

that the process of organizational learning is not to be confused with the

codified store of accumulated knowledge of an organization (its intellectual

capital). One may of course feed the other in a continuous process of

"construction and reconstruction of meaning". The key point here is

that organizations do not just capture and process information from the market

and adapt to it, as is commonly supposed. In order to create new knowledge, they

actively engage in reshaping the assumptions on which existing knowledge is

built. This is the reconstruction of meaning or, more simply put, knowledge

renewal.

How do the

four learning activity modes connect to the concept of knowledge renewal? To

show this I will draw particularly on the insights of Nonaka and Takeuchi

(1995). Each phase of the internal marketing activity cycle will be discussed

once more (see Figure

2), this time specifically linked to Nonaka and Takeuchi's four-phase theory

of knowledge creation (their four phases are contained in the bracketed

sections):

1 Energising:

developing common knowledge (socialization: knowledge interactions from tacit to

tacit) What is at issue at this phase in knowledge renewal is the

willingness of employees to pass on to each other their hard won know-how

(Nonaka and Takeuchi, 1995, pp. 56-94).

2 Code

breaking: discovering new knowledge (externalization: knowledge interactions

from tacit to explicit) In terms of Nonaka and Takeuchi's (1995) theory,

this phase is understood as raising tacit knowledge to explicit levels through

creative dialogue.

3 Authorizing:

obtaining cost-benefit knowledge (combination: knowledge interactions from

explicit to explicit) The transfer of knowledge in this phase is from

explicit to explicit, between departments, their decision-makers, and those

proposing changes.

4 Diffusing:

integrating knowledge (internalization: knowledge interactions from explicit to

tacit) New knowledge is not just a matter of processing objective

information (with technologies such as "data mining" and "data

warehousing"). According to Nonaka and Takeuchi's theory, the final

knowledge transfer, completing the cycle, is from explicit to tacit, as new

knowledge is circulated, tested, integrated and codified into new designs,

policies, procedures and training programmes.

A cycle of

activity for knowledge renewal is the other side of the cycle of organizational

learning (Figure 2). The circularity of the process challenges the marketing

assumptions that need to be changed. The shift to "customers first"

logic meant that existing organizational knowledge could be reframed, a

consequence of looking at the world through new eyes. Thus new knowledge was

"discovered" in a new patterning of the verities. Much of what we call

new knowledge occurs in this way, that is to say, when we recognize the

possibility of new patterns of cognition and act them out.

Thus far the

developing theory of internal marketing makes strong connections between

learning activity and knowledge renewal. However, there is one more connection,

and this is the key to the sustainability of the other two. This is the

spontaneous community of participants, shaped within and by a supportive network

of relationships.

My

interpretation is that a series of behavioral intentions underlie relationship

development through the four activity phases for knowledge renewal. These move

from commitment to trust, trust to obligation, obligation to trust, and from

trust back to (re) commitment (see Figure

3).

Given the

initial commitment that voluntary participants bring to any project, these

developmental changes seem to occur as a result of interactions within the

spontaneous community of participants and with supportive executives, not

because of any innate imperatives participants have of their own. As a result of

the experience of working through the four phases, the commitment of

participants is strengthened by their experiences, or it falls away. These

behavioral intentions seem to be cognitive adaptations to the working

environment, where people are learning as they interact with each other, gaining

knowledge as they learn.

Personal

commitment would seem to be of two forms that are often subsumed into the one.

First, a commitment to achieve something or to behave in a certain way and

second, a commitment inspired by obligation to others. In the banking case, the

first involves a personal view of the likely beneficial outcomes of internal

marketing, and the second involves the operation of reciprocal benefits in order

to get things done. For this reason I have retained the separation of terms and

meanings.

Trust, in my

view, is a pre-condition for obligation but not for personal commitment. Trust

in the context of the banking case meant that reliance was placed on another

person or happening in relation to a hoped for or expected outcome. There was

some risk involved, or even faith (as in "blind" trust), and certainly

some confidence in others as a consequence of past experience, or as a condition

of the banking norms of particular kinds of relationships. Some would go further

and say that trust is a precondition of social life (Sabel, 1993).

Certainly,

cooperation in group-tasks comes into play through interactions based on trust.

That is to say, trusting in oneself and containing your own anxiety and, at the

same time, trusting others through interactive experience (Ballantyne, 1999).

Put another way, the interdependence of participants, a condition of effective

group membership, became in part a consequence of dissolving boundaries of

mistrust, one to the other, and between wider coalitions, one to another.

Institutional

economists have argued that risk, not trust, is "exactly suited" to

describing the calculative behaviour of economic actors (Williamson, 1993). Yet

this is a poor indicator of behavioural intent in the banking case. It does not

provide a guide to behaviour in situations where institutional norms provide

limited protection. In the banking case, risks were often faced by acting

provisionally in trust in unfamiliar situations and without formal institutional

safeguards. Trust was viable because it was a necessary condition for a job that

was beyond anyone acting alone.

Interpersonal

relationship development within internal marketing, based on these fluxing

behavioral intentions, is interpreted as the evolution of a series of cognitive

re-appraisals along a personal path to "customer consciousness".

Customer

consciousness can be understood as a belief in the centrality of the customer in

the conduct of the affairs of a particular business organization. This would

seem to align with Groroos' use of the term (Groroos, 1981, 1990). However, I

wish to go further and capture a deeper meaning for customer consciousness as a

form of tacit knowing, a human quality that means more than memory and

perception but relies on both. This is a part of a personal realm of

understanding, an "intuitive" sense that we can know more than we can

tell (Polanyi, 1996, p. 4).

Customer

consciousness is developed through internal marketing and the learning and

knowledge that come from that experience. It may also be renewed directly

through interacting with customers or perhaps through market intelligence, aided

by database "mining" of correlations of customer behaviors. However,

possession of market intelligence does not itself signify customer

consciousness. Just as tacit knowledge is acted out, so is "customer

consciousness" acted out, and observable in action.

In summary,

the tacit knowledge of participants, coming and going, and market research

intelligence provided renewable inputs for the internal marketing activity

cycles. Internal relationship quality, improved customer consciousness, and

enhanced marketplace performance were the outputs, expressed in different ways

at different places (see Figure 3).

I will now

conceptualize the internal network pattern that grew quite spontaneously to

support the internal marketing effort in the banking case. The network of

participants and supporters proved invaluable in generating and facilitating

knowledge transfers of value to the host organization (Ballantyne, 1997, p.

361). Three separate clusters within this network can be identified according to

function. These I have termed catalyst, coalition, and constellation.

Over five

years the recurring activity cycles gained in mass, one cycle giving rise to

another, with the head-office team acting as a catalyst. Their commitment and

continuing support of the network were important as the network drew their cues

from this source. However, in no conventional sense was the overall programme

"managed". It was their task to try to create the conditions,

environmental settings and workshops where "customer consciousness"

might be exemplified and experienced. Care was needed to try to make sure that

every explicit or implicit promise made was fulfilled in action; otherwise the

credibility of the programme was at risk (Ballantyne et al., 1991, pp.

209-10). The umbilical cord to the catalyst was necessary as support at first,

less so as time went on. The catalyst function gave protection from predators by

providing creative space for volunteer teams to work with autonomy and in trust,

enfolded within rounds of their more routine work activity.

Next, staff

coalitions emerged in head office specialist departments, and their self-chosen

function was to provide advocacy and information across hierarchical borders.

The role of the bank's premises department was critical, for example, in

providing political clout for the redesign of customer interactive environments.

Collaboration with specialist departmental stakeholders enabled other

departments to discover new ways to have their goals met within a common

purpose.

Likewise, in

the regions and branches, constellations of internal marketers emerged. Their

function was to provide informed support for regions new to the "customer

first" programme. Again, such involvement was voluntary. The term

"constellation" is borrowed from Wikstrom and Normann (1994) as it

seems apt to talk of a great number of "stars" spreading their light

in newly recognizable patterns.

My

interpretation of these relationship-developing events is as follows. The

network pattern of catalyst, coalitions and constellations grew in response to

the cyclical "spin" of learning activity, the related knowledge

renewal processes at work, and the cohesion provided by strong personal

relationships among the agents of change (participants). Also, I recognize the

role of catalyst in providing constancy of purpose and in maintaining a climate

of legitimacy for the internal network. These are non-trivial issues from my

perspective.

The

organization of internal networks is seldom mentioned in mainstream marketing

literature. The closest links would seem to be innovation and entrepreneurial

studies. Guidance as to how a marketing network operates within a host

organization therefore breaks some new ground. However, we need to consider the

International Marketing and Purchasing (IMP) network theory developed from

empirical studies in industrial settings. Here we find that relationships are

understood as the interplay of activity links, resource ties and actor bonds

(Hakansson and Johanson, 1992; Hakansson and Snehota, 1995).

Nevertheless,

there are two interesting points of difference. First, the banking network was

located within one company rather than comprising many companies within one

network. Second, the banking network comprised individual employees, acting as

an internal agent of change in a service company setting, not business to

business activity. This leads me to support the conjecture of one leading

relationship marketing author that all marketing activity develops

through interactions within networks of relationships (Gummesson, 1999a, p. 73).

Thus my

working hypothesis (following Gummesson) is that all marketing is grounded in

interactions within networks of relationships, regardless of defining industry

groups and regardless of legal-rational company borders. On this basis, all

internal marketing is potentially relationship marketing turned inward. If the

purpose of this activity is knowledge renewal, then it comes down to the choice

of traditional or relationship marketing methods, and making important

judgements about the degree of company-wide cooperation available.

The specific

implications of this research for the practical development of internal

marketing are as follows:

| The

potency of internal marketing depends on the circularity of a multi-phase

relationship development process and the evolution of a voluntary staff

network of advocates. | |

| Three

strands of the relationship development process work together and are

interdependent. These involve learning activity, knowledge renewal, and the

behavioral intent of the community of staff participants. | |

| Transactional

methods of internal marketing (especially one-way communications) have a

limited potency for knowledge renewal, except for the promulgation of

explicit and indisputable facts. The more complex the task, the more

important it is to work through the relationship development cycle in all

its modes to generate purposeful knowledge. |

The strength

of internal (relationship) marketing is its intent coupled with trusting

employees and being trustworthy. The forgotten truth is that organizational

knowledge is renewed through interaction and dialogue. The traditional marketing

mindset blinds us to the fact that with collaboration, across departmental

borders, new knowledge and interdisciplinary tools are available.

Internal

marketing of the ambition and scope of the banking case is unlikely to succeed

as a stand-alone departmental effort. Marketing may provide leadership but the

cycle of activity demands collaboration between departments.

"Energizing" and "diffusing" involve new learning behaviors

and thus require the cooperation of HRM, and "code breaking" and

"authorizing" beg support from operational departments.

It is a

matter of concern that the market orientation literature has not recognized that

internal marketing is a way of engaging employees in knowledge renewal, as a

unique resource for competitive advantage. This is especially so when some

theorists include inter-functional coordination and learning organization theory

as part of their concept (Narver and Slater, 1990; Slater and Narver, 1995).

Internal

marketing is a strategy for relationship development for the purpose of

knowledge renewal. The case study interpretation suggests that the limits to

creating new knowledge within networks of relationships are where you want to

put them, be they external, internal, or the borderlands between the two.

Figure 1 Internal marketing matrix, Source: David Ballantyne (2000)

Figure 2 Internal marketing as knowledge renewal, Source: David Ballantyne

(2000)

Figure 3 Knowledge renewal as relationship development

Figure 4 Interactions within networks of relationships, Source: David Ballantyne

(2000)

Prahalad

(Prahalad and Ramaswamy, 2000), entrepreneur and professor at the University of

Michigan Business School claims that, as firms incorporate the customer

experience into their business models, the "co-opting of customer

competence" relies heavily on the supply chain. We believe that in the

extraction of value from relationship assets, suppliers do indeed play a dynamic

role in creating corporate worth and growth and are a key determinant of a

firm's performance and ultimately market valuation. Careful attention and

measurement must be given to this component of the value chain.

A firm's

supply chain is a network of facilities that aims to have the right

products/services in the right quantities at the right moment, all at minimal

cost. Historically, many firms have viewed the dynamics of this complex system

as being out of their control, or simply as the cost of doing business. Today,

the Internet is acting as a great "aggregator" of supply chains. With

the ability to create electronic supply-chain processes and real-time delivery

of information, and the ability to review and contract with suppliers from

anywhere in the world - all nearly instantaneously - many firms now find

themselves on equal billing with the largely closed environment of the EDI-based

supply chains of the past. Additionally, information-based supply chains -

largely driven by the Internet - are chiefly responsible for mass customization,

real-time demand forecasting and decreased production and inventory costs, all

aspects of the supply chain that a company such as Dell Computer has enjoyed -

and exploited - for years.

| Dell

Computer, among many other firms, not only has been exploiting effective

supply-chain management for years, but also is realizing considerable

financial returns in the process. Supply chains must be managed not just to

create efficiency or to reduce costs, but to achieve growth and maximum

market value. |

In the end,

supply chains, regardless of the technological form they take, are increasingly

becoming a competitive differentiator and, thus, one of a firm's most important

assets. Proper focus and management are in order to exploit the value of this

asset. According to supply-chain analyst and Newton (2000, p. e6) with AMR

Research:

Companies

are no longer competing so much on their products as on their supply chains.

For many

industries today, sources of revenue as well as the ability to craft and execute

strategy come through means other than the firm itself. Forward-thinking firms

recognize that the economic ecosystem "contract" is the tie that binds

their success in the marketplace. As such, value from the various partner

relationships must be evaluated with the same rigor as other relationship

assets. Although many firms have a variety of partnerships, we believe they can

fundamentally be divided into two distinct categories:

1

alliance partners; and

2

distribution / indirect channel partners.

The ability

to leverage alliance partners is no longer a "nice to have"

proposition, but rather a strategic imperative today. In fact, in the last two

years alone, more than 20,000 alliance partnerships were formed worldwide, more

than half of which were formed between competitors. Furthermore, the typical

large company manages 30 or more alliances, which account for anywhere from 6 to

15 per cent of its market value (Kalmbach and Roussel, 1999). Why the sudden

explosion of alliance creation? One factor may be due to the tremendous time

constraints and financial pressures imposed on firms as they seek to maximize

competitiveness with limited resources. Another driving factor may be the

expensive failure of many acquisitions over the last several years. Alliance

partnerships are proving to be not only a good vehicle to achieve the growth

goal, but also an extremely important corporate asset.

Alliance

partners typically constitute relationships between firms focused on filling

single and multiple gap deficiencies, creating integrated products and/or

services or forming a breakout offering. Joint partnerships might also leverage

R&D capabilities as a means of sharing costs or creating proprietary

technology or standards. In an era of increasing speed, creating alliance

partnerships can also serve as a means of getting to market faster, ahead of

competitors.

Many firms

rely heavily on distribution and indirect channel partners. Indeed, some sectors

of the economy, for example, high-tech and drugs, sell as much as 60 to 70 per

cent - even 100 per cent - of their product through indirect channels.

Delivering the right product or service, at the right time, at the right place

and at the right cost may require multiple sales channels, especially for firms

competing in global markets. Indeed, for firms to compete in such markets, both

direct and indirect selling are necessary. Therefore, the channel partner, while

in some respects under threat via the Internet, is still a viable and thriving

component of a firm's relationship assets. Managing channel partners for market

value creation is tricky at best. However, partnerships, whether they are in the

form of alliance partners, channel partners or both, do significantly enhance a

firm's ability to create value in the market and, thus, its financial

performance.

Furthermore,

firms that successfully integrate and manage partnerships enjoy higher

profitability on their alliances. Successful partnerships see 20 per cent

profitability, as compared to only 11 per cent for the less successful

companies. Revenue generation from high-success alliances equates to 21 per cent

of a firm's overall sales, as compared to 14 per cent of low-success

partnerships. Those numbers will rise to 35 per cent and 24 per cent,

respectively, by 2004 (Harbison et al., 2000). However, research from

KPMG suggests that as many as 70 per cent of all partnerships fail to achieve

stated goals (Murphy and Kok, 2000).

As firms

seek to close ever-complicated strategic gaps, they increasingly embrace

partnerships to achieve their goals. But what constitutes a successful

partnership if up to 70 per cent fail? Determining partnership success is

complicated at best because many partnerships do not establish measurable goals

- nor do they actively measure the outcomes of the partnership. Perhaps the best

way to determine success is through understanding why partnerships fail.

According to KPMG, firms identify, select and engage in partnerships through a

variety of "hard" and "soft" reasons. Hard selection

criteria are based on rational, objective reasons such as market position,

complementary skills, financial strength and geographic reach. Soft selection

criteria are based more on intangible aspects such as commitment, chemistry and

trust. KPMG's research suggests that in the 70 per cent of strategic partnership

failures, 30 per cent of the reasons are attributed to the hard issues of

complementary skills and market position, and 70 per cent to the soft issues of

chemistry, commitment and culture (Murphy and Kok, 2000). So relationship

issues, rather than structural issues, are perhaps the largest determinant of

partnership failure today.

Careful

partner selection, coupled with the ongoing management and the nurturing of

trust throughout the lifecycle of the partnership, is critically important to

ensure optimal performance. Firms seeking to generate positive value from

partnerships would do well to carefully determine their full impact within the

overall scope of their relationship assets, and then select, manage, measure and

learn from their partnerships appropriately.

Channels Relationship

Model (CRM)

According

earlier definition of marketing channel as an array of exchange relationships

that create customer value in the acquisition, consumption, and disposition of

products and services. Each component of this definition is embedded in the

channel relationship model.

The term

array refers to the assortment of human (social) interactions that occur within

and between marketing channels. In the CRM, there are three fundamental human

interactions.

1.

Within the marketing

organization (intraorganizational).

2.

Between marketing

organizations (interorganizational)

3.

Between marketing

organizations and their environment.

How do these

exchange relationship play out in the market ? fundamental changes are currently

unfolding in nearly all industries and these changes are redefining the nature

of the marketplace. The needs of industrial users and consumers are becoming

increasingly sophisticated, to the point where many now insist on consultative

and vale-added partnerships rather than impersonal and brief encounters. The

array of exchange relationships is critical to the development of customer

value.

Creating customer value

Four

components of customer value:

For customer, marketing channels create form, place, possession, and time

utilities.

Maintaining

customer relationship:

Investing in efforts to maintain existing customers is far more cost efficient

than investing in attracting new customers. In fact business spend six times

more money attracting new customers than they do to keep existing ones. About 70

percent of complaining customers will continue doing business with an

organization if they perceive the problem had been resolve in their favor.

Typically, the newly satisfied customer then spreads the good word to about five

other people. Given such word-of-mouth communication, it is obvious that the way

problems within the customer-supplier relationship are resolved has far-reaching

ramifications. And the opportunity to develop long-term customer relationship is

not limited to product manufacturers or suppliers.

The

CRM captures four classes of exchange relationship in marketing channels:

1.

The relationship between a

channel member and its external environment.

2.

The relationship between a

channel member and its internal environment.

3.

The relationship between

channel systems.

4.

Long-term relationship between

channel members and their channel system.

One of the

most dynamic information technology (IT) topics of the new millennium is the

area of customer relationship management (CRM). At the core, CRM is an

integration of technologies and business processes used to satisfy the

needs of a customer during any given interaction. More specifically, CRM

involves acquisition, analysis and use of knowledge about customers in order to

sell more goods or services and to do it more efficiently. It is important to

note that the term "customer" may have a very broad definition that

includes vendors, channel partners or virtually any group or individual that

requires information from the organization.

In IT terms,

CRM means an enterprise-wide integration of technologies working together such

as data warehouse, Web site, intranet/extranet, phone support system,

accounting, sales, marketing and production. CRM has many similarities with

enterprise resource planning (ERP) where ERP can be considered back-office

integration and CRM as front-office integration. A notable difference between

ERP and CRM is that ERP can be implemented without CRM. However, CRM usually

requires access to the back-office data that often happens through an ERP-type

integration.

CRM

principally revolves around marketing (Kotler, 1997) and begins with a deep

analysis of consumer behavior. It uses IT to gather data, which can then be used

to develop information required to create a more personal interaction with the

customer. In the long-term, it produces a method of continuous analysis and

refinement in order to enhance customers' lifetime value with the firm. Wells et

al. (1999) noted, "both [marketing and IT] need to work together with

a high level of coordination to produce a seamless process of interaction".

However, in order to work effectively with marketing, IT managers need an

understanding of the fundamental marketing motivations driving the CRM trend.

Long ago,

businesses were well adapted to managing customer relationships; the old

mom-and-pop grocery store is a good example. Customers were greeted by name;

staff knew exactly what each customer ordered, what things they preferred, and

how likely each customer would pay on time. As a firm's knowledge of marketing

"advanced", the needs of any one customer were lost in exchange for a

more efficient trend known as a marketing orientation (Pride and

Ferrell, 1999). A notable result of the marketing orientation is what is now

coined as customer segmentation. Segmentation is essentially

aggregating customers into groups with similar characteristics such as

demographic, geographic or behavioral traits and marketing to them as a group.

Consequently, each member of the segment has similar needs and wants; however,

they are not completely uniform. The result was that customers often received most

of what they wanted but still had to compromise on many desires.

This method

was a cost-effective way to target groups of customers and proved to be a strong

competitive advantage. However, after nearly five decades of use, customer

segmentation is no longer the competitive advantage it once was and is now often

considered a minimum requirement of doing business. In order to regain the

competitive advantage, leading firms are now ushering in a new orientation that

might be termed a customer-centric orientation (see Figure

5).

During the

1850s, businesses could sell almost anything they made. Consequently it was a

seller's market and businesses focused on production. Early in the 1900s,

competition was creeping up and businesses realized customers wielded more power

and firms had to find reasons for people to buy their products. This brought

about a sales orientation. By the 1950s, businesses began to realize they had to

make what people wanted instead of trying to convince them to buy whatever they

had to sell, which ushered in the marketing orientation. The marketing

orientation focused on addressing the needs of market segments. We are now at

the beginning stages of a new customer-centric orientation.

A

customer-centric firm is capable of treating every customer individually and

uniquely, depending on the customer's preference. As Berger and Bechwati (2000)

put it, the "core of relationship marketing is the development and

maintenance of long-term relationships with customers, rather than simply a

series of discrete transactions". They further note that a guiding

principle is the management of a customer's lifetime value (CLV). Rather than

calculating profit from a discrete transaction, the firm must consider the value

of a customer over his or her entire relationship with the firm.

Many are

likely to argue that a customer-centric orientation is simply a subset of a

marketing orientation and an extension of segmentation (down to a one-to-one

relationship). The author of this article disagrees, in that companies will now

fundamentally have to change the way in which they market their products - it is

a fundamental shift from managing a market, to managing a specific customer. In

a marketing orientation, firms were still very much in control of the marketing

mix, in the future, firms will be driven more and more by individual customer

preferences.

As an

example of this trend, Levi's can custom tailor your next pair of 501 jeans, and

perfumes and cosmetics can be quickly blended for specific users. Nearly

everyone can imagine a car-buying experience where they had to purchase

something they did not want, missed out on an accessory that was not available

or both. Customers are forced to compromise because manufacturers make products

for groups, not individuals. However, in this day and age, it is hard to accept

why it is so difficult to get a car exactly as you want with so much technology

available!

CRM was

invented because customers differ in their preferences and purchasing habits. If

all customers were alike, there would be little need for CRM. Mass marketing and

mass communications would work just fine (McKim and Hughes, 2000).

In the

future, the firms most successful will be the ones practicing CRM. Wells et

al. (1999) summarizes the overall philosophy of CRM, by saying:

... a

one-to-one marketing paradigm has emerged that suggests organizations will be

more successful if they concentrate on obtaining and maintaining a share of each

customer rather than a share of the entire market, with IT being the enabling

factor.

So, what is

fueling this new shift in marketing? One word: Technology. Niche firms have

always had a role in customizing products, but it is just recently that

customization of products and services on a mass scale have become a realistic

objective; thanks mostly to fast, low-cost, networked environments.

With the

above discussion on the fundamental understanding of the business and marketing

principles driving the CRM trend, let us now turn our attention to the IT

manager's role in creating the technical infrastructure.

Figure 5 Business orientations of the last 150 years

The value

creation and management rules of the new century focus squarely on

relationships. The value of the firm's relationships - the relationships with

customers, employees, suppliers and partners - constitute its most valuable

assets. In an era of intense competition, price battles, daunting human resource

issues, globalization, product and service commoditization and near technology

overkill, once the smoke has cleared, businesses are left with the relationships

they acquire, build and maintain. The value of relationships is what firms must

stand on. And understanding the value of these relationships and how to maximize

that value will determine the winners and losers in the twenty-first century.

Developing

an efficient, leveragable framework for measurement and management of a firm's

relationships is, therefore, paramount in the quest for maximizing market value.

Intangible

assets, by their very nature, are hard to quantify and measure. The reality is

worldwide-adopted accounting principles, developed 500 years ago, are used by

nearly every business enterprise today to value and account for assets, namely

assets that are tangible. And these principles and rules, enforced by

government-regulating bodies, say little or nothing about accounting for or

valuing intangible assets, beyond the accounting for goodwill in merger and

acquisition transactions. That being said, there are efforts focused at the

university, private and even governmental levels on creating standardized

practices to measure, account for and report intangible assets, especially in

Europe and the USA. However, the best guess consensus is that we are many years

away from realizing standardized, broad-based intangible asset accounting

practices. In the meantime, businesses of all types are left to their own

creativity in how they measure and ultimately manage their intangible assets.

Fortunately, there are a few guiding principles that have been put forth by both

academicians and practitioners over the last few years.

As with many

assets, there can be multiple ways to measure their value. Unfortunately,

intangible assets pose difficulty in even finding a single method to measure -

with accuracy and confidence - their real value. There are no standards in

place, at least at the discrete, component level. There is no hard-defined

science behind valuation and measurement techniques. However, there are a few

valuation "equations" that managers and executives can leverage to

begin to measure the value of these hidden assets. A few major methods are

listed below:

| Market-to-book

ratios. This ratio is

perhaps the most widely used ratio today to determine the value, or worth,

of public companies. The measurement itself is rather simple: price share

?total number of share outstanding = market value. Subtract book value (i.e.

book assets) from the market value number and you have either a positive or

negative number, indicating the value of intangible assets or possibly,

intangible liabilities. The market-to-book ratio would be considered a

market-based approach. | |

| Tobin's

Q. Developed by Nobel prizewinning economist

James Tobin, the Tobin q compares the market value of an asset with

its replacement cost. Tobin developed this calculation as a way to predict

corporate investment decisions independent of any macroeconomic factors such

as interest rates. Summing up the equation, if q is less than 1

(i.e. if an asset is worth less than the cost of replacing it), then it is

unlikely that a company will buy more assets of that kind. In the reverse,

if an asset is worth more than its replacement cost, a company will likely

invest in similar assets. While Tobin's q was not developed as a

measurement of intangible assets, it is a good one. Tobin's q would

be considered a cost-based approach. | |

| Cash

flow. This approach basically looks at the income

producing capability of the asset (including an intangible asset) to be

valued. The future economic benefits are equated to the present value of the

net cash flows anticipated to be derived from ownership of the asset. The

calculation of the present value of the cash flows is derived by utilizing

an appropriate discount value of the factor, which will of course be

different at each company. Cash flow would be considered an income-based

approach. | |

| Calculated

intangible value (CIV).

Created by NCI Research and the Kellogg School of Business at Northwestern

University. The CIV, in essence, compares the average return on assets of a

company versus that of the industry. The CIV doesn't measure market value,

but rather measures a company's ability to use its intangible assets to

outperform other companies in its industry. The CIV would be considered an

asset-leverage approach. |

The reality

is, since most businesses don't even know what intangible assets they have, the

ability to accurately measure their value is most difficult, especially at the

individual asset level. As intangible assets, and particularly relationship

assets, continue to take center stage in the minds of companies and even

governmental institutions concerned with creating accounting standards for these

assets, broader and more refined measurements will be developed.

The old

adage "If you can't measure it, you can't management it" rings

especially true with intangible assets. For hundreds of years we have measured

and managed tangible assets, but the focus on measuring and managing intangible

assets has just begun. By example, Celemi, a knowledge management services firm

based in Sweden, offers practical steps in the management (and measurement) of

intangible assets.

Celemi uses

what it calls an intangible asset monitor (IAM), developed by author and

knowledge management consultant Dr Karl Erik Sveiby. The IAM not only provides a

system of measurement, but a system of management of intangible assets as well.

Celemi has been using this system since 1995. The company uses the IAM to

monitor three overall intangible asset categories:

1

customers (external structure);

2

people (competence); and

3

organization (internal structure).

Under each

of the interdependent categories, Celemi tracks three key areas:

1

growth/renewal;

2

efficiency; and

3

stability.

Each has its

own set of specific performance indicators. An excerpt from Celemi's (2000) 1999

annual report, shown in Figure

6, reflects how the company monitors its intangible assets.

Celemi has

developed a color-coding system in order to help them monitor the overall

performance of their intangible assets. Cells that are colored green (grey in

Figure 1) are an indicator that the measurement is equal to or greater than

their strategic plan target. Red (black in Figure 1) cells indicate values less

than 80 per cent of target. Yellow (white in Figure 1) cells indicated values in

between.

At first

glance, this system may appear to be purely a measurement and performance

indicator tool. However, Celemi clearly uses their IAM as a management tool as

well. First of all, the tool allows Celemi to understand how well they are

positioned for the future; it acts as a lead indicator. This allows Celemi

management to understand better where resources need to be allocated and managed

to improve effectiveness. Second, the IAM allows Celemi leaders to ensure the

company is growing in line with its strategic plan and to be alerted to untapped

potential in the way they are developing and managing their business. Lastly,

the IAM allows Celemi not only to set overall strategic goals for the global

business, but enables global managers to set their own goals based on

marketplace differences - and to manage their businesses appropriately.

Ultimately, Celemi's IAM serves as a framework to develop, measure and manage

their intangible assets (in accord with their tangible assets) in order to

create and deliver positive future opportunities.

Figure 6 intangible

asset monitor (IAM)

Relationships and the

interaction process

Long-term

inter-firm relationships

Three

types of exchange relationships:

1.calculative exchange relationships 2. ideational exchange relationships 3.

genuine exchange relationships.

Four

elements that are associated with all exchange episodes: 1.products and services 2.

information exchange 3. financial exchange 4. social exchange.

Four

stages of channel relationships:

1.awareness 2.exploration 3.expansion 4. commitment

Apply

the basic principles of relational exchange to buyer-seller dyads: there are five levels of

relationships may develop as markets move from the discrete transaction to

relational exchange. 1.buyer-seller relationships is high discrete. 2. is

reactive marketing 3. known as accountability. 4.is demonstrating continuing

interest in customers. The interest should be proactive. 5. is a real

partnership. Here, sellers form alliances with customers.

Strategic

implications for the new millennium

Channel

relationship council members unanimously agrees with the primary proposition

forwarded in that, as Seong-Soo Kim put it, ‘the future of marketing channels

lies in long-term, ongoing and flexible relationships.’ According to our

expert panel, in future channel settings interaction process will be

increasingly open and will feature a multi-layered sharing of information and

resources.

The channel

relationship council offered several other projections pertaining to interaction

processes within marketing channel settings:

1.

Network development

2.

Standard information formats

3.

Increased interdependency

A

relationship perspective of marketing channels was continuously endorsed in the

study. Relationships are hardly simple connections. They can be stripped down to

little more than webs of expectations shared between channel members. The nature

of these webs of expectations should continue to evolve as marketing channels

draw closer to the new millennium. In any marketing setting, actually achieving

an accurate reconciliation of prediction with outcomes is something of an

Olympian feat in and of itself. Still, channel members had darn well better take

a strong interest in the future, because that is where they are going to spend

the rest of their competitive and cooperative lives.

Relationships

between various country or people or religion has a large difference, therefore,

if we want to reach real partnership and maintain long-term relationships

between channel members, then cultural, identity and image factors are what we

should concern.

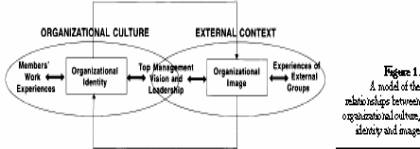

Besides

review relationship among suppliers, customers, employees and partners, the

study also has addressed relationships between organizational culture, identity

and image. In the theoretical conceptualization of these relationships the study

has suggested an analytical framework that focuses on bridging the internal and

the external symbolic context of the organization (Figure

7). Although the concepts of organizational culture, identity and image

derive from various theoretical disciplines that have traditionally focused on

different constituencies of the organization, we have argued that they are all

symbolic, value-based constructions that are becoming increasingly intertwined.

The intertwined symbolic texture of the organization provides a number of new

management challenges and opportunities which were explored along with the

research implications of our argument for the field of marketing.

Figure 7 A model of the relationships between

organizational culture, identity and image

Source: Mary Jo Hatch, Majken Schultz

(1997)

Stepping

into 21st century, marketing channel already enter into a IT

(information technology) era, therefore, elements of marketing besides

“people”, “culture”….etc., IT is a key element for enabling marketing

and to create value in customer relationships.

IT

enabled marketing: a framework for value creation in customer relationships

Social

exchange theory explicitly views exchange relations as dynamic processes (Heide

and John, 1992). How will these "dynamic" process be affected by the

increasing information intensity of customer-firm relationships made possible by

IT and its use in marketing? The costs of the technology required to run

individually addressable customer focused activities lends itself to gaining

economies of scope rather than simply those of scale. Boynton (1993) describes

such IT systems as "systems of scope", that is, systems which allow

managers within the organization to rapidly develop, gather, store, and

disseminate information across all boundaries about markets, products, or

process capabilities. "Systems of scope are designed to maintain stable,

permanent reservoirs and conduits of knowledge about internal capabilities or

experience as well as the capabilities of competitors. They are designed to be

dynamically responsive for managers who have a need to know and must be able to

access firm-wide knowledge in response to local, fast-changing business

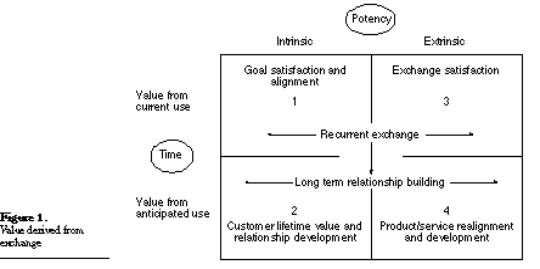

environments". (Boynton, 1993). Such IT capabilities will This involves

firms in broadening and deepening the scope of their product/service offerings

to exploit their customer knowledge and to define their businesses according to

the customers they both understand and serve best (Blattberg and Deighton,

1991). An example is seen in the expansion of the Virgin brand name to include

not only music, but travel, food and personal finance - all driven by an

understanding of the "core Virgin customer". This approach to business

definition will increase the importance of understanding the goal satisfaction

required by customers, the source of their intrinsic satisfaction with the

relationship. Because "systems of scope" make information available to

all managers, are fast, and offer a degree of self-design (Boynton, 1993), the

introduction of such systems increases the need for guidance in their use and a

clarity of purpose in the creation of value for both the firm and its customers.

Another

crucial area of business concern which has been impacted by IT enabled marketing

is that of inter-firm strategic co-operation. Interfirm relationship strategies,

where co-operation requires a thorough study of the partner firms' business yet

yields the reward of access to important information, is seen by Parvatiyar et

al. (1992) as providing opportunities to create economies of both scale and

scope (the importance of which has been discussed). Cross-selling, new

distribution channels, and unique product/service offerings are all ways in

which co-operative marketing strategies can enhance customer relationships for

the firms' involved and increase customer choice. Increasingly information is

seen as an integral and important part of the firms' offerings and a key factor

in determining their extrinsic market value (see Figure

8).

The impact

of IT upon marketing practice has been seen in the development of the ability to

both individualize offers and develop two-way communication between customers

and firms. These developments have led to an increase in the information

intensity of the firm, and to an increase in the importance of activities which

take place outside the immediate boundaries of the customer/firm relationship.

In particular, those of the legal and ethical environment and the arena of